New vehicles gain ground in allocating capital to the real estate industry

Portugal: Which is the best investor choice?

The Portuguese leaders of the real estate sector have met on the 23rd of April, where they have analysed the best options to invest in the country. Over the course of 2022 and 2023, new vehicles have gained ground in allocating capital to the industry and the net asset value (NAV) of national real estate alternative investment undertakings (OIAs) grew by almost 20%.

Around two hundred managers and professionals attended the Portuguese Real Estate Investment Vehicles & Financing Conference, a half-day event that took place in the distinguished Hotel Pestana Palace in Lisbon. For the effect, Iberian Property counted with the support of JLL, Morais Leitão, Norfin, Refundos Explorer, and Square Asset Management.

The first presentation of the morning was given by Inês Drumond, Vice President at CMVM, who began by remarking that in Portugal there is a notable correlation between the property market and economic cycles, which partly explains the performance differences compared to other Eurozone markets.

Inês Drumond highlighted the relative resilience of the residential property market in Portugal. Although there have been some recent signs of cooling, in contrast to other jurisdictions and the euro area, the price index is still on an upward trajectory (annual rate of change of 8.2% in 2023). In terms of transactions, there was an across-the-board reduction in both number and value in 2023.

However, the Vice President of CMVM points out that in Portugal residential property transactions tend to react more quickly to unexpected interest rate rises than prices. When the increase in inflation is considered, these growth rates are lower, but still around 4%, and once again well above what is seen in other European Union countries (the majority with negative rates).

One of the reasons for this is the shortage of supply, as there are still significant restrictions on construction, not only in terms of labour availability but also in terms of licensing processes. On the other hand, rising interest rates and construction costs have made it even more difficult to produce new homes.

A different trend can be seen in Commercial Real Estate (CRE). In this segment, expectations regarding price developments in Portugal are positive compared to other European economies.

OFFICIAL PHOTOS GALLERY

Access here all the photos of the Portuguese Real Estate Investment Vehicles & Financing ConferenceRegulatory context of Real Estate Alternative Investment Schemes in Portugal

On 31 March 2024, the net asset value (NAV) of Portuguese real estate alternative investment undertakings (OIAs) reached 14.78 billion euros. Between December 2022 and December 2023, the NAV increased by almost 20 per cent (18.33%).

After the sovereign debt crisis, the financial sector as a whole and obviously investment funds suffered a significant reduction in demand, with a scenario of relatively significant net redemptions and early liquidation of closed property investment funds that was later reversed with the improvement in economic conditions.

“But what we have seen in the more recent past, particularly from 2019 to 2021, is a positive level of net subscriptions, given that in the face of still low interest rates there has been a search for yield”. However, with the rise in interest rates these open-ended property investment funds have faced other competing financial products, and in the accumulated 2022 and 2023, net subscriptions totalled -280 million euros (vs +600 million euros approx. between 2019 and 2021).

According to the expert, the recent increase in VLGF is fundamentally related to closed-end real estate investment funds (256 closed-end funds vs. 14 open-end funds), the result of the natural evolution in the property market itself, but also the creation or conversion of real estate companies into collective investment entities now known as SICs, “an attractive alternative due to the asset management regime and the tax framework”.

In terms of portfolio composition, AIOs' exposure to CRE is predominant, especially in open-ended funds (on average are much larger than closed-ended funds). Debt levels are residual, and liquidity is higher in open-ended OIAs compared to closed-ended ones, easily understandable as open-ended real estate OIAs are subject to liquidity pressures caused, for example, by an unexpected increase in redemptions, which justifies higher liquidity levels.

“Although recent years have seen greater participation by non-professional investors in OIAs, we note that a very significant percentage continue to allocate their savings predominantly to deposits, and for us to have a more robust capital market it would be important for there to be greater diversification and allocation of capital to this segment”.

"Management companies need to evaluate their liquidity, market, and sustainability risks".

Inês Drumond final words focused on the role of CMVM and the need to find a balance between market development/promotion of financial stability, and market integrity/investor protection. In her view, management companies must have mechanisms suited to the current risks and context, of which she highlighted liquidity risk, market risk (importance of correct asset valuation) and sustainability risk (growing regulatory requirements and monitoring of ESG transition risks).

Portuguese Economic Outlook for the Real Estate market

Also through a keynote presentation, Carlos Albuquerque, President at ‘Fundação Económicas’, ISEG, shared an economic outlook for the country and what factors investors should be on the lookout for.

The Portuguese population has been more or less stabilised for 20 years, but in the last four years the resident population has been growing mainly due to immigration. According to the professor, last year alone “Portugal received 80,000 foreigners and that is putting pressure on the property market because we need to ensure that these people can live in comfortable homes”. Similarly, the population in higher education hasn't gone down either, on the contrary Portugal a significant number of foreign students also in need of housing solutions.

If there are no significant changes, the projections indicate a significant ageing of the Portuguese population structure, which will become significantly older. To this, sums the difficulty related to the number of dwellings built which remains very low compared to the first decade of the 21st century.

The lack of offer is part of the reason for the relative price of housing in Portugal, as of 2015, remaining higher than the ones observed in other countries. Another figure worth commenting is the average number of months a property stays for sale on the market, which fell from 12 to 6 months in the last 10 years.

In addition, the ISEG representative also delved into the distribution of new mortgage lending operations, showing that there are no operations with an LTV of more than 90% (in 2018 operations with this ratio accounted for 20%). Also noteworthy, the weighted average maturity of new mortgage loans is getting closer to 30 years, the value recommended by the Bank of Portugal. Proof of this positive debt approach are also the credit defaults, which have been at very low levels for many years – NPLs currently at 2.7%, compared to 17,2% of the credit stock in 2016.

Finally, Carlos Albuquerque also left some notes on housing policies in Portugal, highlighting the new government's programme which, although not extremely ambitious, goes further than the stability plan and is expected to restore confidence to the market.

To comment in depth the presented outlooks, Manuel Puerta da Costa, CFA, moderated a roundtable debate, kicking off the discussion with a simple question: after all, what explains the Portuguese economic good performance, and is it sustainable?

Paula Carvalho, Chief Economist at BPI Gestão de Ativos, explained that “in relative terms, our performance is good, but in absolute terms our productivity and wealth generated is still far below that of the eurozone”.

According to the expert, the structural changes following the Troika's intervention have been important to now sustain an economic growth without creating imbalances. We have some data to commend of these recent years: on the one hand, external debt has fallen by 17 percentage points compared to 2019, and on the other hand, the indebtedness of companies and individuals has also fallen (from 600 to 400 billion). “This reduction in the leverage of our economy is a positive reflection of the country's robustness, and in fact in terms of risk premium we are paying less than other Southern European countries, such as Spain and Italy”.

In what regards to the current context, António Nogueira Leite, Board Member at Hipoges, clarified that when we mention interest rates we're talking about cyclical variations, and what our sector really struggles with, especially in its residential component, are structural challenges that are far from being overcome.

“I don't see any major problems in the Portuguese property market this year, as the economic cycle is still quite reasonable, and we don't have any oversupply problems in either residential or commercial property. On the contrary, what we really need is to increase supply in order to avoid a long-term problem”, he added.

For João Pratas, President of APFIPP, the country is reacting with ease to the interest rates and surrounding threats of recession. When questioned about the possible movements of funds entering/leaving the country, João Pratas defended that “on the European picture, Portugal is representative at a commercial real estate level despite its limited supply, but where we don't yet have any scale is in the residential market, especially in terms of affordable housing”. However, even if we have a diversified number of open-ended property funds, if they don't have a product to invest their capital in, they will inevitably either lose their subscriptions or abandon the country.

The president of APFIPP also pointed out the importance of additional incentives in the policies that will be adopted so that institutional investors can allocate capital to the affordable housing segment, since “in the future this could even become a response mechanism for our threatened social security sustainability”.

A final optimistic view on the banking system was given by António Nogueira Leite, who believes bank managers today are much better at analysing risk than they were 15 years ago and, as a rule, are much better qualified than before.

For him the shift to be aware of relates to Basel 4, as banks won't be so willing to finance property loans - said to be taking place as early as 2025. In other words, “this type of credit will become much more expensive, and what could happen is that we'll see the birth of more credit funds, depending on the creation of new regulations”.

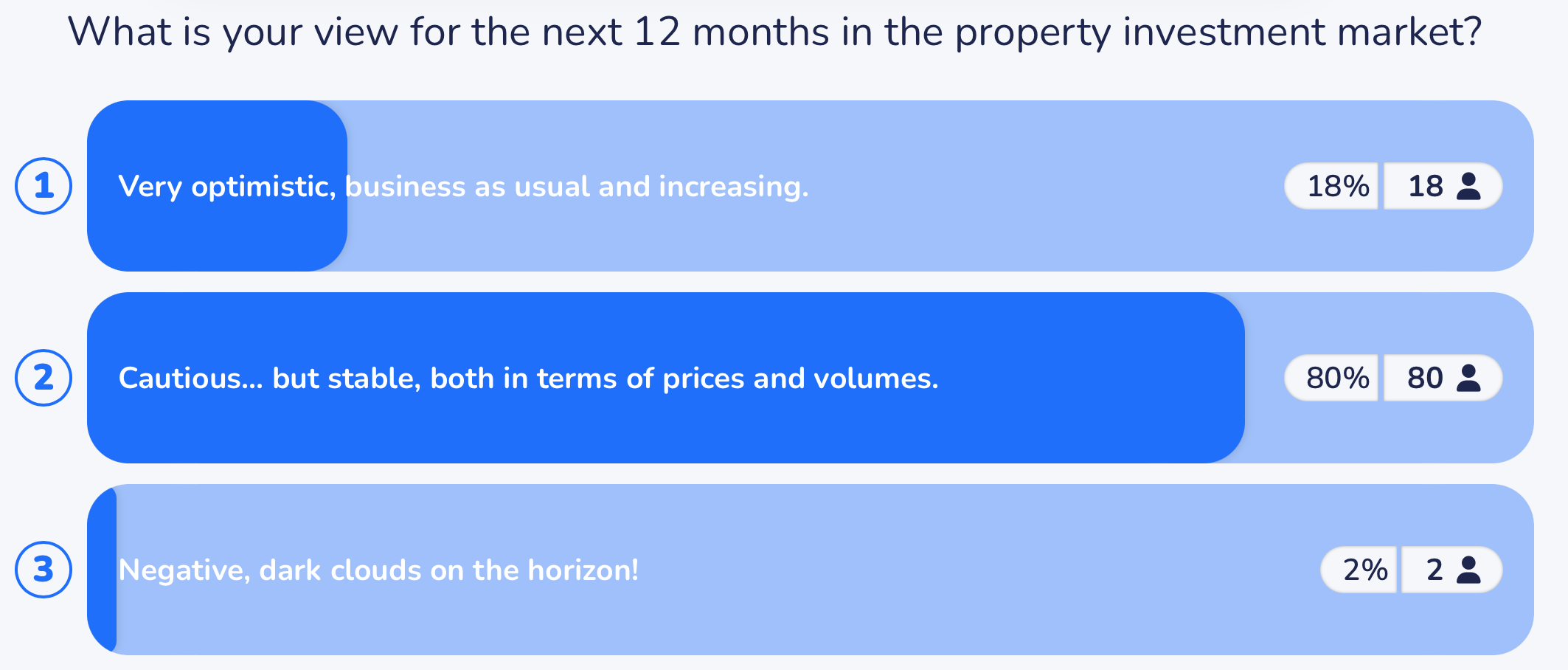

As for the audience, a positive view prevailed, which through an online poll showed that 18% were very optimist, 80% cautious but stable, and only a residual share with a negative opinion for the next 12 months in the property investment market.

Choosing a vehicle model – main considerations

After the coffee break networking, Morais Leitão kicked off the second part of the event with a comparative analysis of Portuguese Investment Vehicles, digging into what might be the best route for each kind of real estate player’s & the future of listing alternative.

Marisa Larguinho, Senior Lawyer at Morais Leitão, centered her analysis in 4 types of vehicles: Limited liability companies (SA), Real estate investment Funds, REITs (SIGI), and Real estate investment company (managed by a ManCo).

There is not a “one size fits all”, and when choosing between vehicles investors need to have into account the governance and control, investment policy and restrictions, and the tax regime.

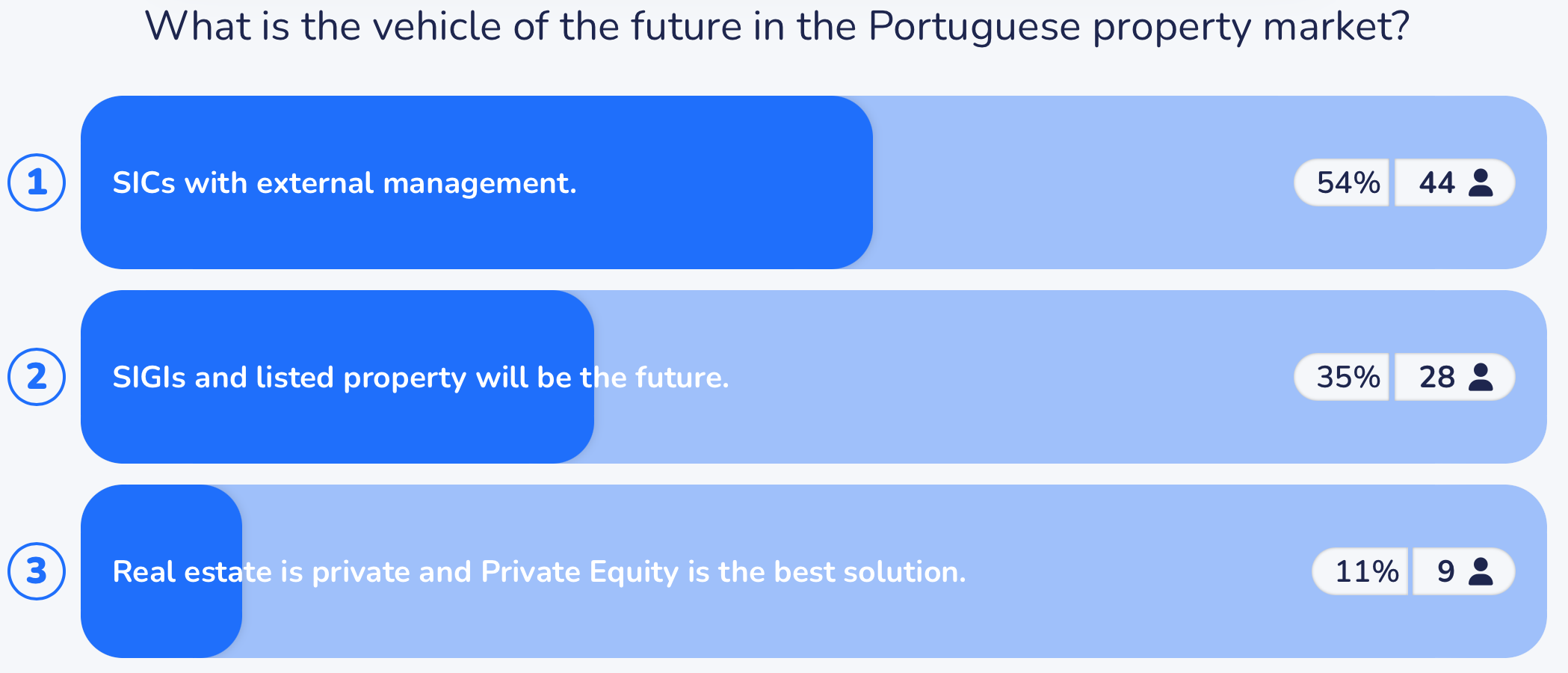

For Marisa Larguinho, a more robust structure is observed in collective investment companies (SICs), and from a pure investment point of view, it's natural to get closer to SIGIs due to their professionalized management. On the other hand, from a more commercial point of view, unregulated vehicles will probably prevail.

"The legislation may be very advanced, and the regulator supervision evolved and less intrusive, but at the end of the day the tax issue still carries the most significant weight."

Ana Carrilho Ribeiro, Senior Associate Lawyer in the tax practice of Morais Leitão, detailed the comparison between SIGI and common funds/SPVs (SA).

Funds are subject to IRC, but they are exempt in 3 specific types of income, which are: capital income, property income and capital gains. In the case of SIGIs, capital gains have a caveat: on the sale of real estate, capital gains will only be exempt when those assets have been allocated to a rental activity in the last 3 years, which is not the case with other vehicles, and naturally makes them a little less attractive from that perspective.

A few years ago, there was discussion as to whether property development activities could qualify for the capital gains exemption, and when an order from the Secretary of State for Tax Affairs finally confirmed that they did, there was a clear increase in interest in these vehicles.

As a final note, Ana Carrilho Ribeiro highlighted that there is an exemption from withholding tax on rents paid to these vehicles (SIGIs), which is not the case with a public limited company - subject to the normal regime, where there will be a 25% withholding tax on rents. Dividends and capital gains earned by non-resident investors are subject to a tempting 10% tax rate, and so we are dealing with a regime that is essentially an exit tax regime, while the income is being generated on an on-going basis the vehicle is generally exempt, taxation only occurs at the exit, i.e. on distribution.

The Portuguese investment market is becoming increasingly sophisticated, and to find out what best suits investors, António Gil Machado, Partner of Grupo Iberinmo, moderated a roundtable discussion to gather on stage representatives from the private and public worlds of real estate.

Miguel Costa, Tax & Structuring Director at Sonae Sierra, began by clarifying that from his experience there is interest for all formats when it comes to investing in Portugal, and Sonae Sierra has assembled all types of vehicles for its clients. Regarding the listed companies he explained that the SIGIs followed the example of the Spanish Socimis, although the Portuguese ones they didn't have an easy start. “Now we have better prospects that the scheme (SIGIs) could boost investment in Portugal, but the dispersion requirement compared to other European REITs is too demanding, and the financing structure also needs to be improved to do so”.

For Pedro Seabra, CEO of Refundos Explorer, overall, the vehicles are very transparent in Portugal, which makes it easier to attract international investors. In his view, “when we have both the assets and the regulator in Portugal, it makes sense for SICs to enjoy a certain degree of success, because there's no better bet than a management company that knows the particularities of the local market”. The CEO also defended that SICs could be a stable solution to many of the market's problems, such as the lack of residential rental supply, because what they do is bring more and more investment to the market.

In the same line, João Lino de Castro, CEO of Lynx Asset Management, illustrated that SICs have the great advantage of allowing for the board of directors to monitor a company's bank balance on a day-to-day basis, which translates in investors’ confidence.

On the other hand, what he believes cannot be missing is fiscal stability – “a foreign investor doesn't accept recurrent significant changes”. From a legal point of view, in the case of closed-end funds there is no reason for an investor not to feel comfortable. The speed with which an investment organisation is approved today is to be commended.

“I doubt there is any country in Europe today that can approve a fund more quickly than Portugal”.

The relatively greater stability of returns and of the Portuguese property investment market is also in part due to the prudent management of open-ended property funds. Being the main representative of these vehicles in Portugal, Pedro Coelho, CEO of Square Asset Management, shared that open-ended funds have existed for 35 years in Portugal, and only at the time of the sovereign debt crisis did they have negative returns, but during all the other years they not only had positive values above inflation, but also higher returns than fixed-term bank deposits.

But to what extent do open-ended funds live off the commercial will of the banks to open the distribution channel?

Pedro Coelho answered that “first of all there have to be investors willing to deploy capital, and only after we assure a good asset management comes the question of distribution channels”. In his opinion, technological developments could create new distribution channels, with the funds being commercialised anywhere in the world.

Finally, João Cristina, Portugal Director of MERLIN Properties, argued that there are already REITs present in Portugal, which in their DNA are very long-term investors, but clearly there are basic changes to the SIGI regime that could greatly favour the country. “For me, a SIGI shouldn't be limited to a company incorporated under Portuguese law; other companies with similar regimes should be able to opt for this regime through their branches or subsidiaries, i.e. the branches of a European REIT should be subject to the same tax transparency as a Portuguese SIGI”.

In addition, he defended that Portuguese subsidiaries should not be subject to withholding tax, provided that the dividend is distributed to a SOCIMI in the Spanish case, or SIC in the French case.

The immediate calculation will show that there is an immediate loss of revenue for the Portuguese tax authorities, nonetheless João Cristina is 100% convinced that through the multiplier effect of investment on GDP, this additional attraction of investment would mean that the later collection of other taxes such as VAT or IRS would more than compensate for this immediate loss.

"Every euro earned over the 35 million barrier is taxed at 31.5%".

Being Merlin Properties a dual listed company (listed in both Spain and Portugal), the Portuguese director argued that Spain has a much more business-friendly tax system from an investor's point of view. “I would like for it to not be true, but the current taxation in Portugal is terrible. We must simplify things...it doesn't make sense to have a non-deductible VAT rate of 23% on property, especially if we want to attract foreign capital, because we mustn't forget that our market is peripheral”.

João Cristina went further on and revealed that the current regime doesn't favour scale. “If I have a very large company, I can achieve economies of scale, but the problem is that the tax regime doesn't allow companies to be large. If we start adding up different taxes, we see that every euro I earn over €35M is taxed at 31.5%”.

How to finance real estate development and investment?

From traditional banking industry to new alternative funding vehicles…is the bond market finally able to be a financing source in Portugal?

To provide insights on this matter, Amadeo Gimenez, Director of Debt and Structured Finance for EMEA at JLL, hosted a keynote presentation showing that traditionally, Bank financing had a prominent role on the overall financing structure of any real estate project & development, but bond issuance and other alternative sources of capital (equity, hybrid and structured debt) have become more available in Portugal.

Everyone expects to see a reduction of interest rates, but the big question for investors now is who are going to be the active lenders. By mid-2022, both the Euribor and European central bank interest rates entered an upward rally not seen since the inception of the Euro, leading to a steep reduction of investment volume linked to the now more expensive financing.

The JLL expert, began by providing figures on the banking system, exhibiting that the aggregated volume of AUMs of the Top-50 European banks adds-up to around €35 trillion, while the AUMs of Top-50 US banks add-up to €21.4 trillion, which means the banking system in Europe is almost 50% bigger than in the US.

EU banks hold almost €1.4 trillion in Commercial Real Estate loans, raising concerns about their vulnerability to rising interest rates, inflation, and a weakening economic outlook. The median exposure to CRE for European banks is about 6%, while for US regional banks it is about 36% and for large US banks it is about 16%.

As a common factor to the banking system in Iberia, Amadeo Gimenez defended that consolidation is unavoidable and expected to persist. The process of restructuring in Spain led to a decrease from more than 60 banks and savings institutions in 2008 to barely 10 commercial banks in 2023. In Portugal, a similar trend is occurring, albeit on a different level and pace.

Bank’s loan books exposure to real estate and construction has been considerably reduced (- 62%) since 2008, and somebody needs to fill in the gap. “One of the problem many developers are financing for the new construction, that’s why second homes are algo gaining expression in the market”, argued the expert.

"On average we have a need of around 310 billion euros of new financings in Europe per year".

In 2018 when the rates were at their lowest and banks financing activity was a bit more bullish, financing was at around 60% LTV. Well, with the adjustment on pricings, regulatory impacts and decline of underlying valuations, European bank finance availability is being pushed to lower levels. As such, banks are now only open to refinance at a 50% LTV as a standard practice, meaning European borrowers would face an aggregate hole in their capital stack of 64 billion euros, so we need to be a bit more open minded to other sources of financing.

However, the JLL Director of Debt and Structured Finance rest us assure that thanks to the current variety of lenders, there should be sufficient liquidity for a wide variety of situations covering the full capital stack. The total facility amount, as well as the term, might vary significantly depending on the typology of the final lender and sponsor. Currently, any financing process should focus on targeting a wider array of lenders with the objective of securing liquidity.

In his view, besides the local banks we will see more insurance companies lending, and for higher ticket transactions the big investment banks will be more active (although in Portugal this is still not visible). The alternative lenders are also expected to gain ground especially when it comes to more value-add projects.

Alternative routes of financing for Iberian players

To explore in detail the different debt models and financing options for projects and assets, Filipe Lowndes Marques, Partner at Morais Leitão, moderated the last roundtable discussion of the conference, gathering two lenders and two borrowers at stage to understand.

From the lending side, what are today’s preferred financing projects? Pablo Álvarez-Rendueles, Head of Origination Real Estate at ING Spain & Portugal, explained that being a global lender ING cannot ignore the global trends, but it’s of extreme importance to understand the local reality. The bank usually prefers financing residential and logistics, but in Portugal these segments don’t have that much scale yet. “In the so-called ‘beds & sheds’ we are also very comfortable financing, but for example offices and retail - now in a grey area in many countries – also work in Portugal since they perform well…so it is really a matter of the local reality”.

Regarding the financial metrics like LTV, it is true that banks tend to be more conservative (being the sweet spot between 50% and 55% at least with a bullet structure).

For Tiago Brandão, Country Head of Portugal at Incus Capital, alternative lenders generally don’t compete directly with banks, because they have very different cost of capital, and they are willing to do structures that banks usually are not. Providing an example, “if Incus is presented with a good asset, that is yielding cash flow with the bullet structure and paying dividends, we may be able to take up to 75% or 80% LTV on the subordinated holdCo financing”.

He added that, alternative lenders also have more flexibility to finance projects where the security is not up to the regulator standpoint, like the case of senior build to rent loans where either because the model in place is of surface rights or a concession, banks cannot get their hands in because it is not a mortgage tick-the-box regulators are happy with.

From the borrowing side, José Cardoso Botelho, CEO of Vanguard Properties, admits that in the past the company went to seek financing with banks due to the lower cost of capital. However, for the projects in pipeline and due to the volumes, the firm is already exploring other options like private equity or family offices willing to co-invest with Vanguard Properties.

Portuguese lenders are perceived for taking, in general, a long time for their evaluations and decision-making process, while being risk averse. The reason behind it is that banks are constrained by both their past and their regulation, explains André David Nunes, CIO of Arrow Global Portugal.

“Legacy banks are extremely good at making certain types of deals, the big difference comes when you deviate yourself from the traditional products”, which applies to alternative living segments. In that case, the CIO argues that banks are not suited to finance projects and, depending on the volume, it might be impossible to work with only one bank for a single asset. From the company experience, forming a syndicate with different banks is a painful and lengthy process, so the following choices are either to work with a big international bank, or to search for an alternative lender who can commit to the needed flexibility, but will for sure be more expensive.

Pablo Álvarez-Rendueles, recalled that Spanish banks decreased their exposure to real estate due to concentration metrics, which opened doors for alternative lenders. “Our internal policies take time to change, and obviously we try to adapt our mindset and diversify our offer, but banks and alternative lenders are complementary, and we don’t see them as a threat”, concluded the ING representative.

On its final considerations, André David Nunes addressed the bond market as a possible alternative for bigger players who wish to finance multiple projects. In his view, one of the characteristics of the Portuguese market that allows us to think this could become a reality in the future concerns to the entrance of financially savvy players, potential borrowers who understand the different characteristics and dynamics of the market. Bond issuances is a very well tested instrument in other countries, and in the Portuguese market it may make sense given the size constraints.

“A bond issuance has much more liquidity, and then it can be easily syndicated and sold on secondary markets, so I do see a potential evolution into that realm, although I don't think that we are there yet”, concluded the Arrow Global CIO.