INTERNATIONAL INVESTORS STEP UP THEIR INTEREST IN SPAIN

Spain Real Estate Summit - 2024

On the 25th and 26th of June, Iberian Property brought to Madrid an event that the real estate sector had for long awaited. In the 2024 edition of the Spain Real Estate Summit, the global property sector was well represented by around 300 industry leaders from a wide range of countries, such as Spain, Portugal, France, Germany, Belgium, Greece, the UK and USA, among others.

With a fresh economic perspective, the Spain Real Estate Summit kicked-off by the hand of Juan María Nin, Chairman of the ‘Circulo de Empresarios’, who addressed how Europe is suffering the consequences of buying time through monetary and fiscal policy. Nonetheless, in his view inflation might be gone before than expected.

The political fragmentation and a possible debt increase can lead to fragility and weakness of the Euro coin, specifically in respect to the dollar. But optimism prevails since structurally the Spanish economy is well adapted to face these shocks. The country current main concerns should be to boost productivity, correct unemployment, strengthen sustainability of public accounts, and of course reduce imbalance between supply and demand in the housing market.

Europe is suffering the consequences of buying time through monetary and fiscal policy.

In the view of the economist, in 2008 a nice “thunderstorm” was prepared, and instead of assuming the end of a cycle we elaborated the possibility of buying time, through two components: monetary policy and fiscal policy.

Today we are still suffering the consequences of not accepting the end of a cycle. And to give response, governments decided that Central Banks (monetary policy) would have a key role.

To prevent economy and society jumping into a big depression, they lowered interest rates to zero and this meant that in a way the macro fundamentals began to receive a kind of kerosene and be topped in order to maintain the situation, but this was not enough…

So besides lowering the rates of interest to minimum, they brought as much money as they could into economy, the so-called quantitative easing.

“I am of the opinion that interest rates have a clear impact on animal spirits so in terms of demand what consumers or investors look at have a very direct link and impact, more specifically in real estate”.

The money accumulated in Wall Street was only moved more than a decade later to High Street, and what we witnessed was the uprise of inflation.

“Now monetary policy is being corrected with deflationary measures. Politics and Central Banks preferred not to look on supply due to its complexity, so they focused on demand by printing money, issuing sovereign debts, and accumulating the gross public debt in Europe breaking never seen records!”

For Juan María Nin, growth will be lower than expected, and unless deficits move ahead and we have an extreme division in politics, American and European economies will not suffer any kind of decoupling.

The micro risks analysis by sector and city are gaining importance, and in a scenario of established low productivity the most professional managers in the real estate industry will differentiate themselves.

2024 the year of improvement, and hopefully 2025 a year of increased growth.

Taking place at La Finca the UZalacaín space, the 2-day conference was organised in collaboration with CBRE and JLL. Through the direct participation of the consultant’s Spanish CEOs, Adolfo Ramírez-Escudero and Enrique Losantos, the discussion of the current and future dynamics of the real estate market in Spain provided insights on 4 main blocks: Market, Sustainability, Technology, and Talent.

Regarding the different sectors, in a nutshell Enrique Losantos considered that the Office sector is still fighting with cyclical and structural shocks; Retail has overcome several challenges; Living with a possible collapse in subsectors.

As for Adolfo Ramírez-Escudero, the market is currently subject to 3 vectors of change: digital transformation, energetic and climate transition, demographics and consumer trends.

In the CEO of CBRE Spain view, capital will probably become scarce, and the cost of capital will therefore not reduce as people expect. Still, he recalled that real estate is a long-term asset, and interest rates should be seen in the same time period, so there are no reasons to panic.

On the other hand, the CEO of JLL Spain highlighted how the market has changed in terms of operators, with a rise of the operational moment due to new demand and trends. “Take the case of offices with flex space, not every landlord understood the opportunity, but we as consultants need to be ready to identify them and provide value for our qualities”.

“Hospitality and fluid interaction are overlapping to several sectors, and trends of pay-per-service and pay on-the-go are dictating a new rhythm”.

In the same line, Adolfo Ramírez-Escudero shared that hospitality and fluid interaction are overlapping to several sectors, and trends of pay-per-service and pay on-the-go are dictating a new rhythm. Institutional and more conservative capital will soon understand that assets need a more active management and that the moment of collecting rents with almost no relation with the tenant have disappeared.

Diving into some of the recent trends, sustainability (the number #5 priority for investors in the last decade) is in the top of the agenda. There is of course some ESG fatigue, but the investors, developers and consultants are aligned in pursuing strategies that allow to reach the net-zero buildings by 2050.

“New uses like stadiums are showing us also how skillsets are becoming a relevant tool to dynamize the market and adapt the current stock to give new life to cities. The question if people are willing to pay more for ESG is still generating discussion, but there is for sure money available to be deployed in it”, concluded Adolfo Ramírez-Escudero.

There is plenty of liquidity for financing the right asset classes

To comment on one of the current hot topics, representatives from Apollo, Carlyle and Santander covered the fundamentals of both debt and equity for real estate.

George Molesworth, Managing Director Credit at Apollo, started by assuring the audience that we are on the right side of inflation and interest rate cycle, and even though last year there was not that much activity, stability was generated.

For its part, Domingo Etcheverría, Principal RE Investment EMEA, Carlyle, agreed and defended that valuations indicators and cap rates seem to indicate that repricing is behind us. Nevertheless, Carlyle is still cautious on the demand side.

With an institutional perspective, Guillaume Baron, Head of Commercial Real Estate Finance EMEA at Santander, stated that Spain is a good shape with GDP outperforming its peers. The unemployment issue is the main problem compared to other economies (11% vs. 6% average).

Guillaume Baron also underlined that the banking industry is reacting, they are doing new origination but also taking care of legacy books, and the increase of leverage provision is a priority.

Focusing on the equity approach, Domingo Etcheverría believes that there is plenty of liquidity for financing the right asset classes, and “the role of alternative lenders is allowing investors to pursue refinancing strategies and obtain 18 or 24 additional months to reach more interesting exit yields”.

Breaking a misconception, Guillaume Baron argued that one thing people should understand is that banks are operating with a certain delay, is to say when the ECB reduces interest rates it won’t mean that the day after the cost of capital will be lower.

Commenting on the role of sustainable finance, George Molesworth stated that we are still in an exploring phase for green financing, however there is for sure demand from both investors and lenders. “Specially, if you consider that people want green buildings it is only expectable that with some time and education the transitioning to green financing will take place”.

From an equity perspective, ESG is seen as a liquidity multiplier, and with valuations being a big challenge better to play safe and comply with the latest trends.

Finally, the Santander representative also gave a few words on the shakeout and restructuring of the banking industry in Spain, which in his opinion is a positive thing. “We now have bigger banks, more stabilized and liquidity was not put at stake. And even if a gap is generated by the merge of local banks, that are a lot of international players available to cover that financing”, he concluded.

AI is changing the world, and Real Estate is a sector than can easily improve profitability by using it

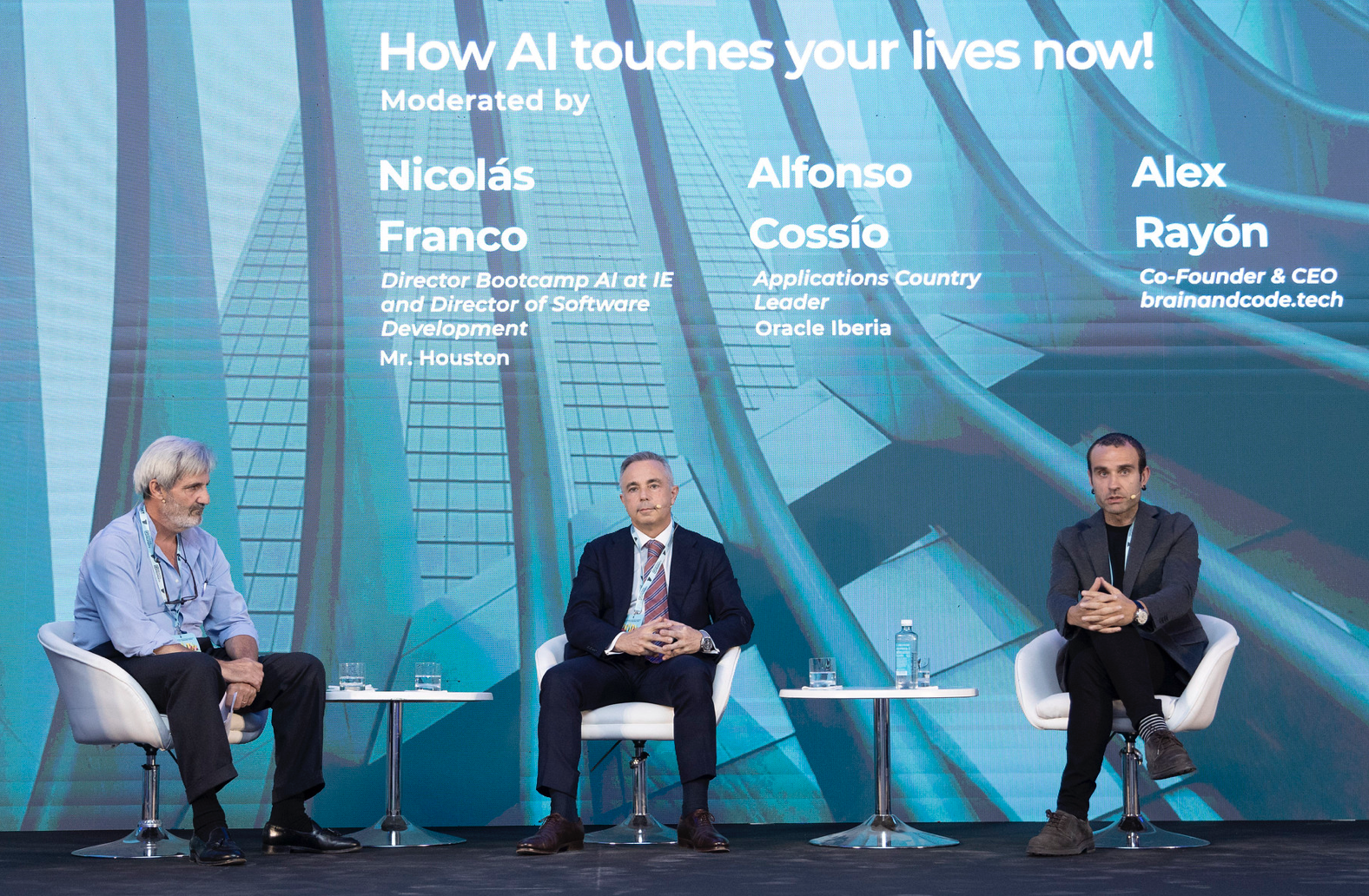

To answer to the tricky question of how Artificial Intelligence can touch our lives as of today, Nicolás Franco, Director Bootcamp AI at IE and Director of Software Development at Mr. Houston, coordinated the last session of the first day. He began to explain that there are two parts of AI that people usually mix-together: the more disruptive being Generative AI, and the more classic AI, such as Machine Learning.

The technological experts confessed that the real estate sector is perceived as very traditional and reluctant to incorporate big changes. Alfonso Cossío, Applications Country Leader at Oracle Iberia, stated that due to the idea that real estate is primarily focused on profitability, software and technological companies are including its Generative AI experience to develop financial models and feature main data to produce reports on property management and asset management.

On the other side, Alex Rayón, Co-Founder & CEO, brainandcode.tech, shared that his company is currently working on 3 main application areas: augmentation of rutinary tasks, coding, and the conversational models (what people still associate to chat bots).

Regarding the main concerns of Artificial Intelligence, Alfonso Cossío highlighted that regulation is coming to soon, we are at a discovery phase, and we might limit the potential of these technologies if the European Union beings to constrain the activity. In his opinion, what we really could use is education.

“In terms of return on investment, the value chain is full of opportunities to use generative AI or classic AI”. At Oracle there are already use cases to anticipate risks of development, to improve maintenance at the property management area, and so on.

For Alex Rayón, there is another issue in the top of his mind. “If I were a real estate company, I would be very worried on intellectual property”. The input data and output result link are still very “shady”, sensitive data is being treated by a complex system with lack of clarity on how it behaves…and there already lawsuits beginning to appear.

On the other hand, he assures that Human brain over the data remains key to prevent hallucination of the AI models and to revise the quality of the outputs.

In what respects to cost vs. investment, both experts agreed that if we talk about the price of implementing a model built from scratch the technology is still expensive, but as of today investors can already access many use cases for free. Besides that, from the user experience it has never been easier to obtain new tools.

The 3 main trends for the next couple of months, according to Alex Rayón:

- We will stop accessing AI, it is going to be around us everywhere.

- Much more capable models on understanding our ideas and desires.

- Ethical dimension will be pushed by society.

Investors celebrate the main achievements of Iberian real estate activity in 2023

And because the sector also deserves to celebrate and enjoy some relaxed networking time, the Iberian Property Investment Awards ceremony were the perfect moment to wrap-up the night. With a total of 8 categories, leading companies from both Spain and Portugal were recognized for their outstanding activity during 2023.

WINNERS - IBERIAN PROPERTY INVESTMENT AWARDS

Get to know all the winning projects and initiatives of the Iberian Property Investment Awards 2024Assets Transitioning: more than a fresh paint job!

After a warm welcome coffee, international and local investors were ready to continue to learn and share their views on the Spanish market. Assets Transitioning was the first topic of the agenda on the second day of the Spain Real Estate Summit, and the representatives from Schroders, H.I.G Real Estate Funds, and Azora agreed that transitioning represents an efficient way to explore assets through optimal use according to each market cycle.

Cristina García-Peri, Managing Director & Partner at Azora, started by clarifying that assets need not only to deliver the right use to tenants but to deliver the right returns…otherwise in the long term they will never be truly sustainable.

For Esteban Caja, Managing Director of the H.I.G Real Estate Funds in Europe, the operating skills inherent to transitioning require changing the mentality, and as he explained when you change the use of an asset you either need to get up a team, buy a team, or engage with a specific skilled partner.

Secondly, Esteban Caja underlined the regulation risk. He recalled that products such Flex living and Coliving are still subject to uncertainty and there are plenty of different opinions on what use can be incorporated.

In terms of returns, the conclusion was that the conversion cost will dictate whether it is a good option or not. Take as an example the change of use of prime logistics rents where rents are 7€/sqm/month to storage units which are at 20€/sqm/month, if the income difference can compensate the capex needed then the project is (in a simplified approach) financially sustainable. Other common transitions are the conversion of offices in secondary cities/locations to residential, moving from rents of 10€/sqm/month to more than 20€/sqm/month.

Making use of its European perspective, James MacNamara, Head of Operating Strategies at Schroders, argued that Spain is being largely “developed-led”, being pretty straightforward to build carbon efficient buildings, while in many other countries retrofitting is still the priority.

From its experience, James MacNamara defended that the Dutch market is probably one of the most advanced in terms of carbon measurement and premium value considerations, since regardless of what regulations are imposing there is a collective sense of responsibility to fight off the obsolescence factors and have updated stock.

Also, he highlighted that there is a merge between Real Estate and Private Equity businesses, in particular for the uses which demand a high number of employees such as hotels, student housing and other types of living.

Regarding the ESG fatigue, Cristina García-Peri shared that although regulation was a positive drive for change, the fear now is that it might be moving faster than what users demand and especially faster than what investors can afford.

“Regulators need to take a pause, because the rhythm they are imposing will eventually lead to a loss of competitiveness”

In affordable housing, for buildings with more than 20 years of existence, if we were to make investments needed to upgrade just the energy certificate from a D to a B level, rents would need to increase in around 50%. “So instead of generating solutions, we would be excluding around 80% of the current tenants of those buildings, simply because they wouldn’t be able to afford the new rents…so the trade-off not always work!”, she concluded.

In the view of the Schroders expert, standardize definitions and narrow down KPIs are something the industry is lacking off. Climate change is another driver of transitioning although it presents strange consequences. “The flooding risks are increasing and there is no clear answer on who should pay for that, investors need to step up their game in the coordination with insurance companies”. Besides that, James MacNamara shared his curiosity in seeing how some investors are moving their preferred locations from the Mediterranean to the Baltic regions due to the heat waves increase in the first.

For its part, Esteban Caja recalled that since transitioning demands both capital and skills, many core investors prefer to sell the assets than incur in a change of use with high risk, so value-add capital may have a clear opportunity to acquire assets at discount and convert it to give it a new updated value.

The advantages in accessing financing at cheaper rates was the last driver mentioned by the experts in what regards to drivers for transitioning. Nonetheless, the lenders are still struggling with what is a green building. “Getting a certification represents what the building could be operating at… but that can easily disappear. We need to have actual data on how the asset is performing day-to-day with improvement of IT to monitor that data. Only then can valuations accurately reflect the ESG compliance of the assets”, concluded James MacNamara.

Key issues for hotels, data centers, retail and logistics.

Spread in 4 simultaneous breakout sessions, the Spain Real Estate Summit featured an intimate moment to overlook the fundamentals of specific subsectors. The sessions were coordinated by Merlin Properties, Grupo Lar, CBRE, and JLL.

The first chair of these sessions, Blanca Martín, Senior Director, CBRE Hotels Iberia, shared that there is a rising interest in hotel investment in Spain and optimism regarding macro and tourism fundamentals. “Hotels is now a liquid asset class, and even though we might not see another 30% share of the total investment in Europe, Spain will for sure remain one of the most attractive destinations”.

Blanca Martín also highlighted the variety of active players and how the entry of new sources of capital like sovereign wealth funds demonstrate that there is limited supply compared to the demand. Besides that, one of the main trends brought up to discussion was the global shift to franchise contracts, representing an opportunity to consolidate white label operators, with cost savings advantages for investors.

Delving in an alternative asset class, Francisco Porras, Data Center Business Unit at Merlin Properties, argued that the data centre industry is still incipient in Iberia, nonetheless the fundamentals are very healthy, specially at a time when Artificial Intelligence is pushing the need to develop more assets. On the other side of the balance were mostly concerns about regulation.

Compared to its European peers, Spain has an advantage in terms of the quality of the grid, generation of electricity, arrival of subsea and internal cables in fiber optics. “There are still many small and obsolete data centres in Spain, but demand is so extensive that occupation is always at the highest possible”. The new generation of these assets is currently fighting for faster access to energy, still the timing of the build permits remains one of the current pain points.

The third on stage to provide conclusions on the retail segment was Eduardo Ceballos, President of the Spanish Shopping Centres Association (AECC), who assured that retail is back!

KPIs are very strong with good growth of sales and visitors. The improvement of unemployment in Spain had a good impact in the consumer spending, and inflation moderation anticipate good prospects. There is only a 1% GLA growth rate per year, meaning the current stock is very consolidated. Eduardo Ceballos highlighted two topics to carefully monitor: first, technology and its impact in better understanding the customers through data; and secondly, the property management to satisfy the ever-evolving tenants’ demand.

Finally, Tom Waite, Executive Director EMEA Logistics and Industrial at JLL, commented that the logistics session covered 4 major areas: types of buildings, locations, rents, and investment cycle. One of the common conclusions was that both developers and investors should follow the tenants to adapt the assets to their needs. In what regards to location participants were divided between a central destination to pursue a long-term sustainable portfolio with good drivers (which can mean buy obsolete assets) or go with the tenant and build under request state of the art facilities wherever the tenant need to be.

Furthermore, pricing seems to have achieved a general stability with influence from other European markets, but investors believe there is still more to come on rental growth.

How do we create space for everyone in the Residential Spectrum?

On the last session of the event, David Martínez, CEO of AEDAS Homes, began by explaining how Spain has gone through an expansive cycle due to the imbalance of demand & supply in housing. As he explained, the INE projections for new households in the next 15 years are of 246.000 per year. To this demand the response is limited. In fact, the whole industry is today only capable of delivering 80.000 units per year, which represents a challenge but also an opportunity for the sector.

Aref Lahham, Founder of Orion Capital Managers, shared that of the 80.000 units produced per year 100% is sold, so fundamentals are great. In his opinion, development companies might have the capability to reach the 240.000 units, but “the truth is that on the construction side we don’t have the same capability, we lack contractors, workforce and more efficient techniques”.

For David Martínez, long-term industrialization will probably help to catch-up, although it is for sure not the only solution. “Other important measure lies in the government role, which should do an effort to bring skilled foreign workforce, such as Hispanic American countries”.

Secondly, Spain is running out of land, consuming it at a way higher pace than the one in which the country produces new land.

The third highlighted factor by the CEO of AEDAS homes was capital. “If we want to double the supply someone has to put on the equity”.

Assuming an average price of 300.000€ per unit and the need to cover an initial 30% of each unit (90.000€), the sector would need an additional 9 billion euros to face the imbalance of supply! (90.000€*100.000 new units = €9 billion).

Karin Koks-Van der Sluijs, Head of Fund Management Europe & Managing Director at Greystar, argued that the level leverage defines who to search for as partners, with national banks or if we need scale we go to debt funds.

On the other hand, in the housing spectrum Karin Koks-Van der Sluijs underlined the concept of Flex Living being very particular in Spain. “We don’t see in other countries the clear opportunity to build residential in tertiary land. And the demand for this product is no longer just young people, we are beginning to see retirees selling their homes to find a community in these buildings, escaping from the concept of traditional care homes”.

Placing it a broader context, Kevin Cahill, Partner and Head of European Investment at Ares Management, argued that the lack of building power is not only a Spanish problem, the same applies to Europe. Looking to 2025, the UK, Germany and Spain will be building around 2 homes for every 1.000 people, while the US is building double that. Still, for Kevin Cahill the big question is how to build for the bottom half of the income earners.

“It is very economic to build 25 sqm studios for young professionals, but if you have a young family earning the average salary of 40.000€/year requiring a 60 sqm apartment building for them means having a squeezed profit, and I believe this is where governments need to intervene”.

He also stated that the case of Plan VIVE was a great first step, with this one policy the Madrid region is increasing the affordable rental housing in 20%, and in 50 years they get back the land and the building assuring their own public financial viability.

Nonetheless, Aref Lahham showed some concerns on the model of collecting 50 years of affordable housing rents, since in the zero interest rates scenario things worked, but now the math has changed, and economic sense has to be reviewed.

The audience also brought up to the discussion the FDI perspective. Lack of housing supply is an urgent situation in terms of investment attraction, and cities who have done a wonderful job in attracting people and capital are now suffering the most from its success.

Concluding with optimism David Martínez, shared that politicians are already talking about the housing problem for a while, so it is a matter of time until they take action. Besides that, he underlined that the new supply will be focused in rental housing for sure, not only due to a general change of mindset for the pay-per-use model, but mainly because (contrary to purchasing a home) people won’t need to have such large savings to put on a deposit value.