Altogether, the players that make up the 2022 edition of the TOP 10 Investors in Portugal traded more than 1.377 million euros, representing a total of 13 deals concluded between January and the end of August.

The ranking is led by Blackstone, the North American private equity firm that heavily invested in the Portuguese logistics sector this summer, with the two leading transactions having reached an estimated 333 million euro, representing a 19% share of the total volume invested in the Portuguese market during the first eight months of the year. Blackstone’s first acquisition was the purchase of a 125 million euro portfolio composed by 15 logistics assets spread across Lisbon, which had formerly belonged to the British asset manager M7. The other transaction was the acquisition of the Connect portfolio, which included mainly logistics assets spread all over Portugal, acquired from GNB Real Estate for 208 million euro – the largest deal made so far within the Portuguese market in 2022.

Round Hill Capital came second. At the end of July, the British asset management company announced the purchase of the Smart Studios network which included a portfolio of 9 operational co-living and student residences in Lisbon and two other projects under development to be concluded this year in Porto and Estoril for a total 200 million euro. Altogether, the portfolio exceeds 2000 beds, and this was the second largest deal of the year, representing 11% of the total amount traded.

The third position is occupied by a Portuguese SIGI, Ores - owned together by Sonae Sierra and Bankinter – which acquired at the closing of August the famous Atrium Saldanha for an estimated amount of 200 million euros. Thus, this Portuguese vehicle could share the second place of the podium, capturing a share of 11% of the total amount traded.

Half of the capital invested is in Iberian hands

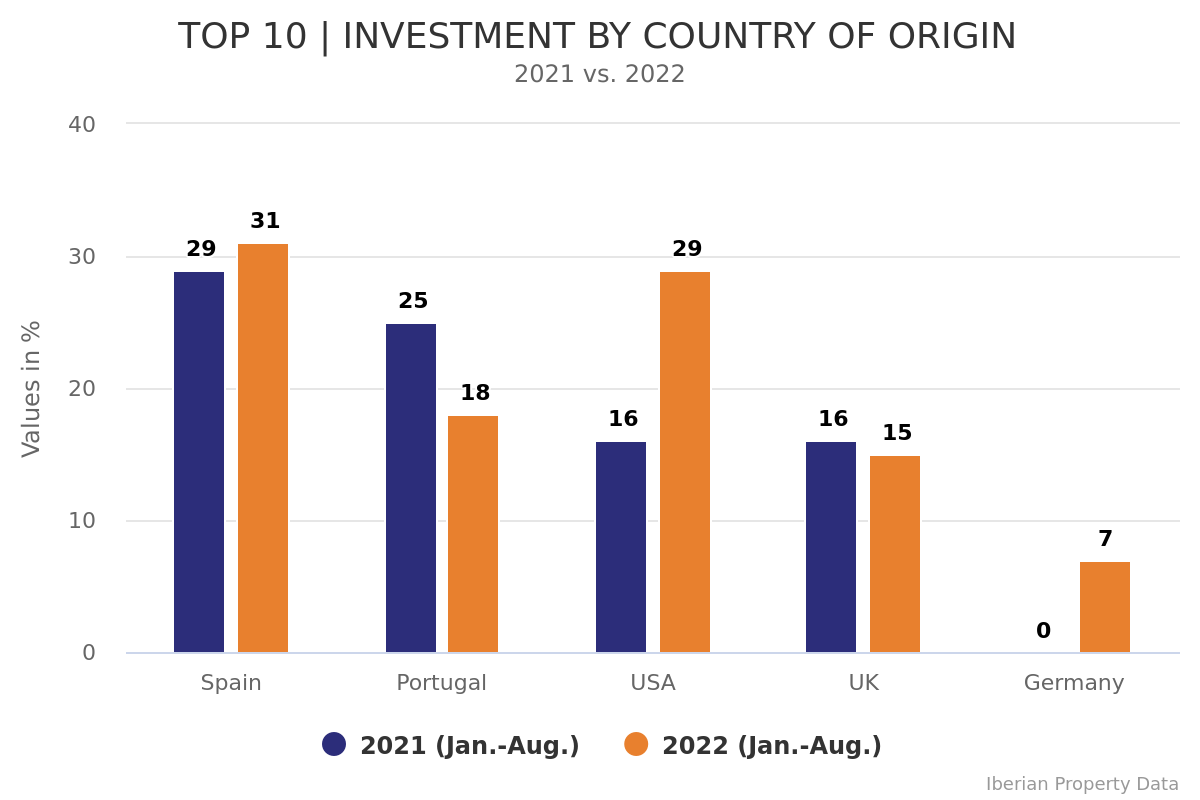

Regarding the investors’ origin, in 2022 Iberian capital reassured its dominance (although with a slight decrease), representing 49% of the volume invested by this TOP 10 whereas during the same period last year it had 54% of the total share. Spain is the prevalent Iberian nationality and the origin of four investors (RBI, Merlin Properties, Azora and Incus Capital), which totalled almost 427 million euros in Portugal through 4 operations (increasing its share from 29% in 2021 to 31% in 2022). On the other hand, Portuguese investors had two players (Ores SIGI and Incus Capital) in the ranking this year, compared with 4 in 2021, which resulted in a smaller share of 18% (compared to 25% in 2021).

The United States was the second most active nationality, represented by two players (Blackstone and AFIAA) which invested a total of 400 million euro in three operations, representing a share of 29% of the total investment made by this group of 10 investors.

The UK ranked in the fourth place, only represented by one investor (Round Hill Capital) within the Portuguese market, with a single operation that amounted to 200 million euro (15% share).

Finally, although through an investment fund with multiple participations, Germany is also present in this ranking, with investments totalling 100 million euros.

TOP 10 players invest almost 3 times as much per deal

The analysis by Iberian Property Data also showed that the TOP 10 investors spent an average of 105,92 million euros per operation, 279% more than the average ticket of 37,96 million euro per operation calculated for the whole market between January and the end of August.