LaSalle Investment Management and the German long-term rental operator Numa Group have created a 'joint venture' to invest 500 million euros in hotels in Europe.

The strategy of the new alliance is to acquire, refurbish and operate hotels that are vacant or about to be vacated, boutique hotels, as well as long-stay apartments that incorporate associated services. It also contemplates capturing projects that involve a reconversion of another class of assets that are now in the hands of other operators, either owned or without an associated hotel chain.

La Salle and Numa focus on real estate located in prime areas of large cities which, once acquired, will be designed, managed and operated by the German company.

In this sense, they have already identified fifteen assets in Spain, the United Kingdom, Italy and the Netherlands, which together have a value of more than 450 million euros.

Both companies expect that, once the transaction has been closed, the reforms of the properties will last between six and eighteen months and that they will offer rooms for short, medium and long stays, providing flexibility to optimize occupancy.

It will also try to introduce high sustainability standards in the assets acquired, such as hybrid ventilation and water recycling strategies, with which it is intended to obtain excellent or outstanding Breeam evaluations, with the aim of maintaining the condition of zero CO2 emissions in the entire portfolio by 2050.

"As COVID-19 restrictions ease across Europe, tourism-driven markets in leisure destinations, as well as European city centers in general, will continue to rebound. This strategic partnership with Numa will capitalize on this by provide a trusted, high-quality, technology-enabled product with an efficient consumer experience in markets that have fragmented hotel stocks," explains Blake Loveless, head of value-add investments at LaSalle.

For his part, Dimitri Chandogin, president of Numa Group, explains that his goal is to establish himself "as the dominant solutions provider for a completely new generation of hotels and short-stay accommodation in Europe."

LaSalle Investment Management manages approximately $77 billion in private equity, debt and public real estate investments worldwide. In Spain, last July, the company acquired the NH Collection Barcelona Gran Hotel Calderón for 125.5 million euros.

The company has also invested in logistics. In fact, one of the last businesses of the subsidiary in the national market was the promotion of two last mile centers in Villaverde (Madrid), built by Engel & Völkers, for an amount of 52.6 million euros.

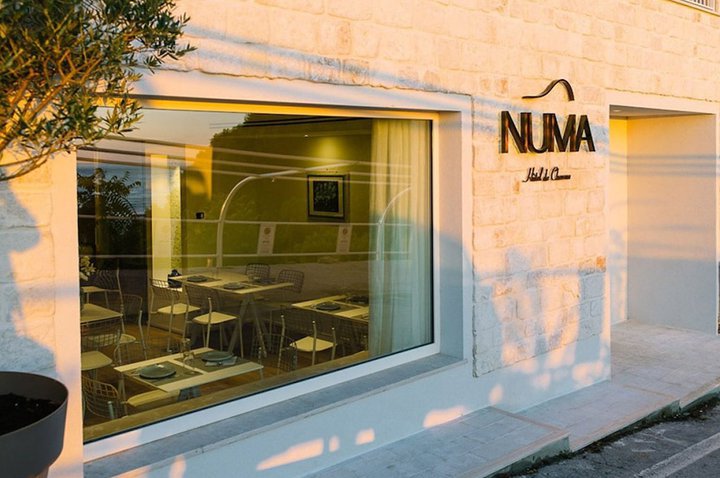

For its part, Numa is a short-term rental company, which landed in Spain in April 2021, after closing an investment round of twenty million euros. It was founded in Berlin in 2019, has assets managed in Madrid, Barcelona, Seville and San Sebastián, and is present in Berlin, Frankfurt, Hamburg, Leipzig, Munich and Vienna.