2017 / iberian.propery // 69

Potential for more than 700.000 m² of offices

22@ is consolidated not only due to its demand for offices; it also involves

a social transformation, urban transformation (current & potential) and

development initiative. Cushman &Wakefield notes that the available

surface area of 22@ at the end of 2016 was only 64.000 m², which rep-

resents an 8% vacancy rate (Available offices at 22@ by building quality: A

48%, B+ 25%, B 13% & C 14%). If we take into account the A and B+ quality

buildings at 22@, the percentage drops to 6%.

At 22@ there is more than 700.000 m² of potential offices, of which

243.000 m² are located on development land. The growth potential of

the stock in the area is remarkable and, if all the projects go through,

the office park in this submarket will double.

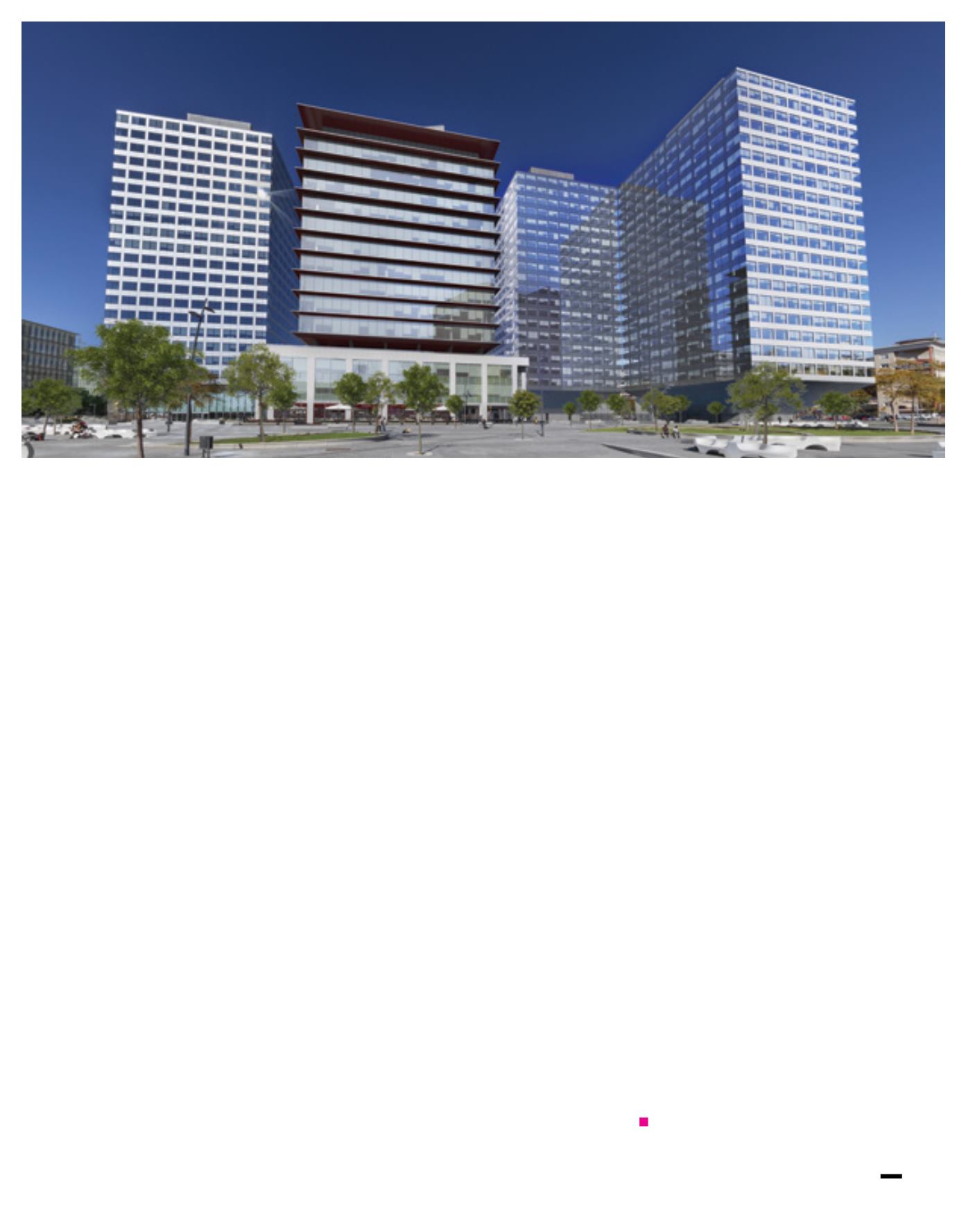

Therefore, over upcomingmonths, projects adding up tomore than 130.000

m

2

of covered area for the tertiary sector will be in the construction stage

or initiating works, among which public and private establishments (for

example, new offices developed by AXA for Generalitat, the twin towers

for the BCN Fira District project by Iberdrola Inmobiliaria –which join Torre

Auditori and Torre Marina, already completed, a turnkey hotel project de-

veloped by Inmobiliaria La Campana, the development of offices adjacent

to the newAgbar headquarters and the Catalan Tax Agency, etc).

Also notable is the proximity to new urban developments with great

potential, such as District 38 (which brings an additional 300.000 m

2

to

the tertiary sector) and La Marina del Prat Vermell (medium term devel-

opment with 80 ha, almost 870.000 m

2

of covered area for residences

and 315.000 m² for economic activities).

The purchase by Merlin Properties of Torre Agbar at the beginning of

2017 marked a milestone in the Barcelona office market and, therefore,

in 22@. The expected increase in take-up in the area for the next years

is sustained by the acquisition of this and other projects that extend to

retail, hotels and land in the area.

«There is an extremely important critical mass of land for development and

under development concentrated virtually in two or three hectares»

, notes

Miguel Ángel García, director of Patrimonio de Iberdrola Inmobiliaria, who

adds that

«so far this year, 22@ has recorded spectacular take-up rates,

consolidating and improving the tendency»,

due primarily to the lack of

quality product in the city and the fact that this is one of the few areas

that can accommodate the demand for large spaces and sustainable

buildings with the highest equipment standards.

A record investment volume of 930 million euros

According to data by Cushman & Wakefield, in 2016 the 22@ district

attained a record investment volume of 930 million euros, 22% more

than the previous record in 2006 and well above the volume in 2015

(180 million euros).

Foreign and national institutional investors were the most interested,

proving that the current market is highly professionalised and the

property profile is comparable to the business centres (CBD) of Ma-

drid and Barcelona. Prime yields for offices at 22@ are between 4.5%

and 5%, surpassing yields in the Barcelona CBD, which closed the

first quarter of 2017 at 3.5%. This differential is attractive to investors,

since the zone is displaying renewed demand for modern spaces

in an excellent location. Investors will be closely monitoring the de-

velopment of land in the northern part of 22@ that has the potential

to house new developments, to maximise on the robust demand

expected for 2017-2019.

BCN Fira District, developed by Iberdrola Inmobiliaria in the 22@