60 // iberian.propery / 2017

dossier// ISSUE: TOP IBERIAN cities

INDUSTRIAL

The lack of quality supply continues to restrict the industrial real estate

market. Nevertheless, the 1st semester of 2017 displayed growth in the

demand for spaces in the Greater Lisbon Area, albeit concentrated in

the prime zones, and on a scale that is still insufficient to correct the high

vacancy rates in the Montijo, Alcochete and Palmela secondary zones.

63

63.000 m² taken up |

14 new occupancies were

identified in the 1st semester, with take-up growing

17% compared with the same period the previous year

3

,75

3.75 €/m² maximum rent |

the low average

rents practised (between 2.00€/m² and 3.75€/

m² per month, depending on the zones) continue

to seriously limit the growth in supply. However,

increasing pressure from the demand side may

enable a rise in rents in some locations.

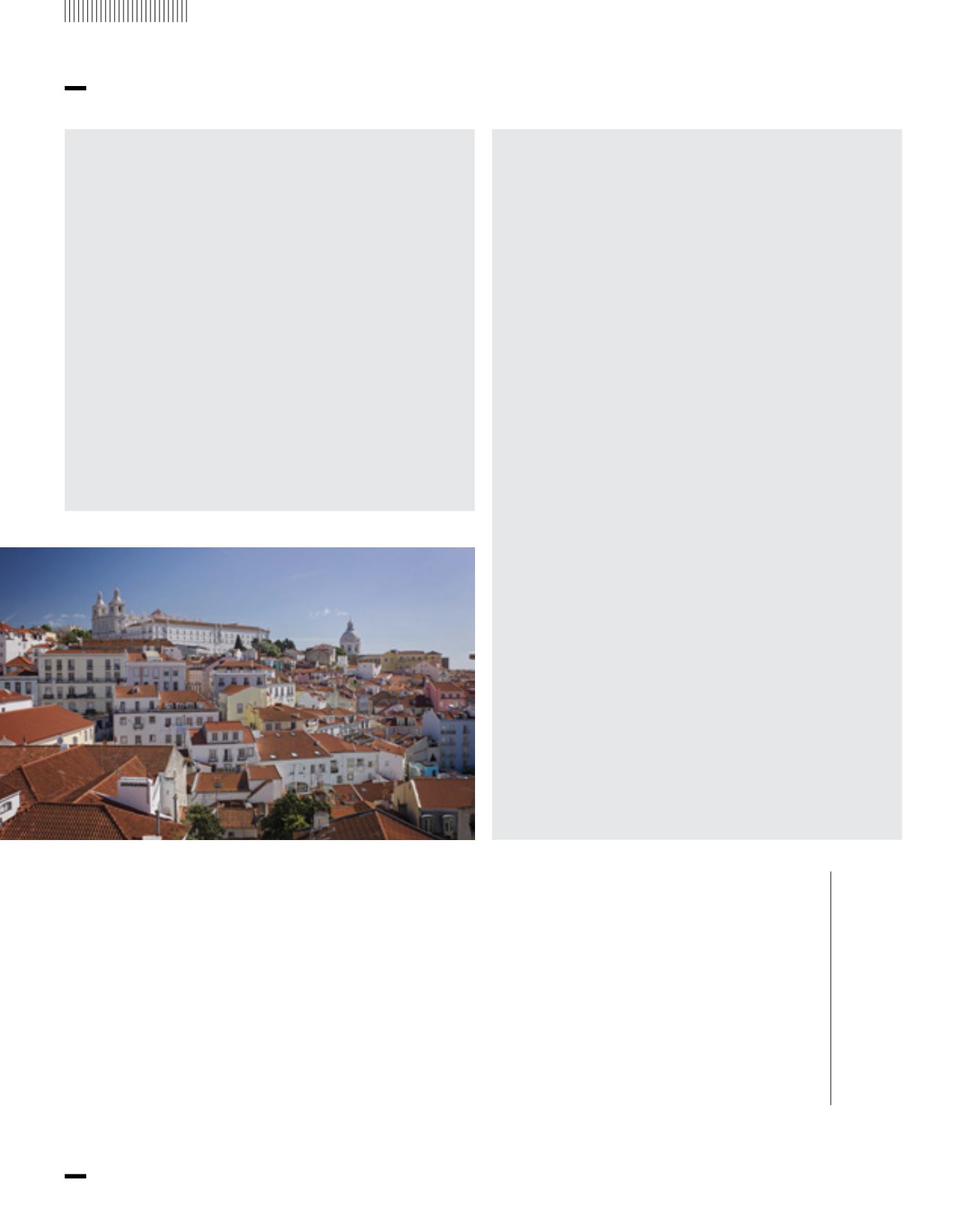

HOTELS

Over the past couple of years, the region has been positioning itself as

the principal tourist destination in Portugal, which was made possible

by the solid growth in the country’s tourism activity. And that growth is

most pronounced in the capital city.

69

69.05 € RevPAR |

RevPAR continues to evolve

favourably in the entire region, and in 2016 this

indicator stood at 59.18 €

90

,6

90.60 € ARR |

Despite the increase in supply, solid

growth in demand sustains the increase in hotel room

prices in the city, which continue to be among the

lowest among European capitals. For the region as a

whole, the average room price was 80.65 €

18

18 new hotels |

Lisbon leads the number of new

hotel openings expected for Portugal in 2017

30

30.646 rooms |

in supply in the Lisbon region at the

beginning of the year, 20.634 of which are in the city

of Lisbon

76

,2%

76.2% occupancy |

the occupancy rate was higher in

the city centre, and was 72.5% for the entire region

5

,6

5.6 million guests |

in the region in 2016, of which

more than 4 million stayed in the city of Lisbon

13

13.146 million overnights |

9.7 million of which were

in the city of Lisbon

Tourism and hospitality are among the fastest growing

sectors in Lisbon’s property market, where there is

still plenty of room to grow. According to Deloitte, the

Portuguese capital concentrates only 4% of the hotel

accommodation units available in Portugal and 5% of the

number of hotel beds in the country.

source: Hospitality Atlas 2017, Deloitte

sources: Cushman & Wakefield, CBRE