SPAIN AND PORTUGAL PRESENTED ABOVE AVERAGE RETURNS IN 2023

The outlook is good, but the recovery is still lacking a firm 'push'

The presentation of the MSCI Index of 2023 across several countries confirmed the European decline in the capital markets, with the investment volume in Europe dropping to 2012 levels - approximately 170 billion euros.

Although the slowdown in dealmaking mirrors the pace set in the Global Financial Crisis of 2008, this time optimism prevails, and the assets valuation suffered a quicker correction. The reflation period is expected to be inverted still during the first half of 2024.

In order to return to “normality” we need to overcome the current mismatch between buyers and sellers, who have different expectations and do not agree on the price point. MSCI identified an important increase in possible distress assets coming into the market, but until now no relevant transactions have been completed.

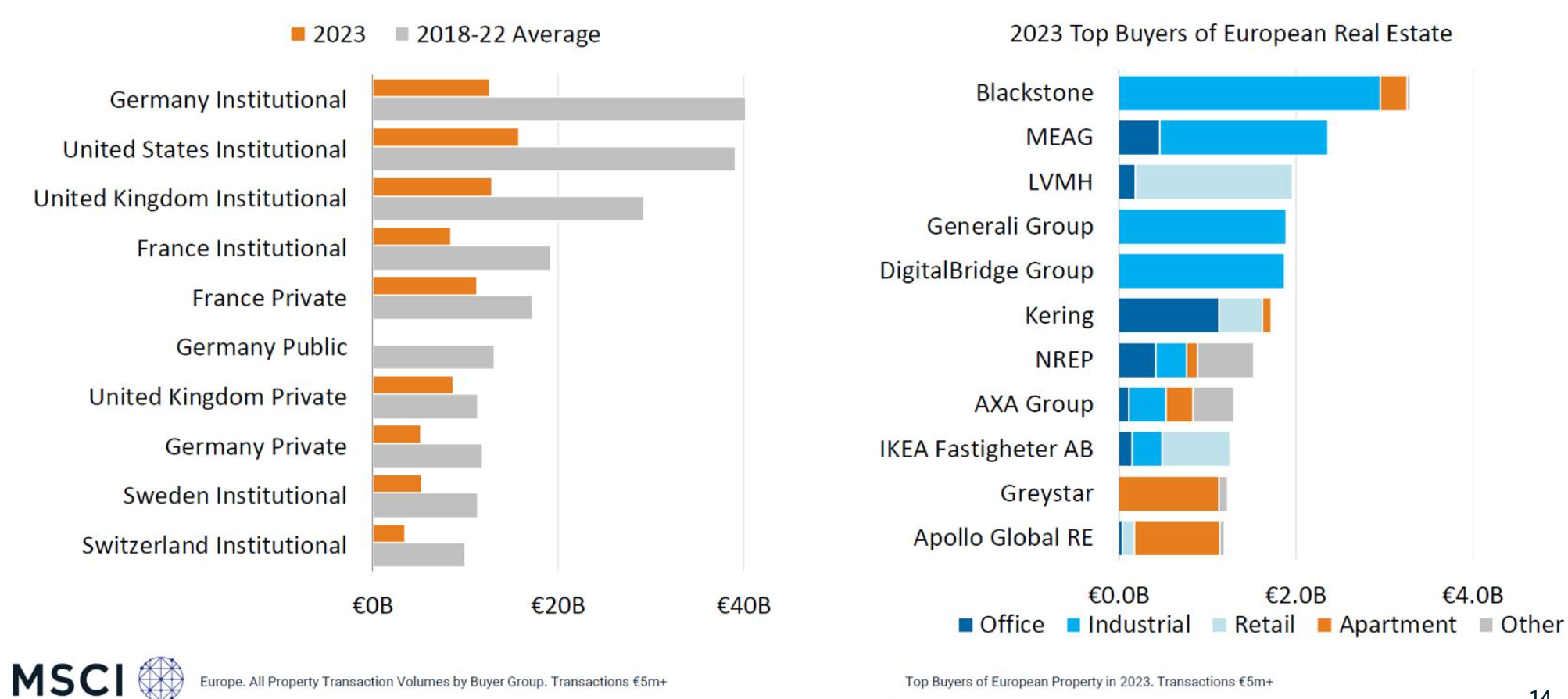

Facing last year uncertainty, institutional investors have reduced their average deal volume in more than 50%, especially visible in the case of German, US, and UK institutional capital. On the other hand, there was room for new players to assume leading buying positions, and the TOP 10 ranking of 2023 brought some surprises, even though Blackstone continued to be the number 1 buyer surpassing the 3-billion-euro mark of investment.

Already showing signs of recovery, the listed real estate sector is outperforming the private market, setting a positive momentum and some renewed faith for the real estate sector.

Portuguese real estate delivered a total return of 6.8%.

In a challenging year for global property investment, in 2023 the Portuguese market showed its strength, returning the highest return among the markets analysed by MSCI: 6.8%, with rising rents "offsetting" the effect of yield expansion. At this stage, some improvements in activity are beginning to appear, but experts don't believe that the recovery is just around the corner.

"Compared to other European markets, the Portuguese Real Estate Index not only showed one of the best performances in 2023 but also has one of the most stable results in the medium and long term," a behaviour that helps to explain the great attractiveness of the Portuguese market, as Luís Francisco, MSCI's Vice President, Real Estate Client Coverage for Iberia, the Netherlands and the Middle East, said at the barometer's presentation session, which took place on the morning of April 16 in the auditorium of PLMJ's headquarters in Lisbon, followed by a round table debate.

In 2023, income property monitored by MSCI in Portugal (a total of 769 assets, encompassed in 39 portfolios with a total value of 8.6 billion euros) generated a total return of 6.8%. Excluding the effect of investments made throughout the year from an active management perspective - which account for only 5% of the sample - the total return of the so-called "standing investments" - i.e. those assets that have been in the portfolios since the start of the year and account for 95% of the sample - was 7%, of which 5.8% was generated by the rental component, while the contribution from capital appreciation was only 1.2%.

"Rental growth had a positive impact on the Index's performance in 2023, offsetting the effect of yield expansion, which contributed negatively to capital appreciation," commented Luís Francisco. According to him, this combination of rising rents and rising yields, which was more pronounced in the first half of 2023, was the “dominant scenario in practically all European markets. The difference is that, unlike what we saw in Portugal, in these markets the pace of rental growth was not enough to offset the negative effect of yield expansion on the capital component."

Hotels and retail in the lead

As in 2022, the hotel sector was the best performer, generating total returns of 10.5% for investors, followed by retail with 8.3%. "However, we must also highlight the good performance of the industrial sector (6.5%), as well as the resilience of Portuguese offices, whose return, despite falling from 7.4% in 2022, remained at 5%, which is still a very positive result in the current global context, especially when we realise that it was sustained by rising rents," notes the MSCI vice-president.

Commenting on these results, Paulo Silva, Head of Country at Savills Portugal, emphasised that "the operational rental markets are very strong in Portugal, allowing for the excellent performance in 2023 and the results we are seeing today".

Also addressing the current mismatch between buyers and sellers, João Tenreiro Gonçalves, Co-founder and Executive Partner of Bedrock Capital Partners, defended that in Portugal, "repricing has been lower than abroad, and some owners of assets with good operational performance are simply unwilling to lower prices due to the recent expansion of yields. And I believe that when this upward movement in yields stops, this solid operational performance will bring many investors back to our country".

In other words, "the outlook is good, but the improvements aren't immediate", summarised Pedro Seabra, Senior Partner at Refundos Explorer. "What's happening is that although there continues to be capital, there is also a lot of geopolitical and economic uncertainty at international level: we have two wars going on simultaneously near European borders, and even the good news regarding the evolution of interest rates has come in dribbles; and all of this has motivated investors to maintain their wait and see position," he observes.

For its part, Elizabeth Mathieu, Managing Director of Southcap, pointed out that, "real estate assets are less liquid than other classes of securities, and their market-to-market valuation often generates a lot of doubt among investors; what's more, their management implies higher costs which, in some cases, correspond to more or less 10% of the return on assets. And all of this has led to some investors leaving this market, albeit temporarily."

Even so, says Jorge Teixeira, CEO of BPI Gestão de Ativos, "the coming wave doesn't signal a slowdown in the market, on the contrary. And if the current wave of Wealth Management that we are seeing abroad also arrives here, it will have a very positive impact on the dynamism of the property market," he comments.

In the view of the head of BPI Gestão de Ativos, there are however some significant changes in the way investors look at property, which should be taken into account. "In recent years, the property market has become much more 'quality', in other words, that old jargon of 'location, location, location' no longer makes sense if there is no quality." In addition, he notes, "decarbonisation is also having a profound impact on this issue of asset quality, namely in the risk assessment that investors make". Digitalisation was another vector of change on the way companies look at offices.

Spanish real estate delivered a total return of 0.0%.

In the same week, Iberian Property has also supported the Spanish Index results presentation, which took place on the morning of April 18 in the auditorium of CMS headquarters in Madrid, followed by a round table debate.

In 2023, income property monitored in Spain by MSCI (a total of 773 assets, encompassed in 73 portfolios with a total value of 21 billion euros) generated a total return of 0.0%. When considering the so-called "standing investments" - i.e. those assets that have been in the portfolios since the start of the year and which have not been sold – the result was negative (-0.8%), of which a positive 4.7% was generated by the rental component, while the contribution from capital growth had a negative impact of -5.3%.

The main conclusions highlighted by Luís Francisco were that despite a slight negative performance, Spain is among top performing markets in 2023, and on a real estate sector ‘like-for-like’ analysis the country has also performed above average. Hotels was the top performing sector in 2023 (10.6% return), followed by retail (2.5% return).

After the presentation of the Spanish results, António Gil Machado, Partner at Grupo Iberinmo, moderated a roundtable discussion in which Alfonso Brunet, CEO of Castellana Properties; Carlos Becerril, Head of Asset Management at Generali Real Estate; Diego Laguia, Investment & Asset Manager at M&G Real Estate; and Antoni Sastre Cuadri, Head of Transaction and Valuation at Zurich, shared their conclusions on last year performance, together with some forecast for the future.

For Alfonso Brunet, there was no surprise in the good performance of the retail sector, and the “I told you so” expression was in order. For many times seen as the ugly duck, retail is now moving to a white swan profile, supported by the fact that average occupational levels are above 95%, footfall figures and sales are also increasing, and the retailers and operators have very “comfortable” effort rates. Furthermore, investors were also able to increase the rents so 2023 was truly a win-win year. The CEO of Castellana Properties believes that 2024 will be even better, with the first quarter already showing impressive figures while leading the investment transactions volume in Spain.

One of the reasons for the relatively good performance of Spain compared to its European peers is explained by its launching point. Carlos Becerril, explained that the southern countries historically had higher interest rates than the more mature markets, contributing to a smaller shock in the latest uprise. Besides that, transactions in Spain are being done with low leverage, and the internal consumption has played a vital role in balancing the economy.

“History may not repeat itself, but it certainly rhymes” – Diego Laguia, M&G Real Estate

Real estate is one of those sectors which follows cycles, and anticipating the shift means obtaining good results. Despite the general picture of a not so favourable cycle, Diego Laguia first comment on the results highlighted the fact that Spain went through its best Hotel investment year. And even with a 0.0% overall return, the being above the European average provides some comfort.

M&G also reconfirmed its full trust in the Living segment, and since the current effort rate to buy a house in Spain is at 40%, Diego Laguia anticipates that fundamentals will remain strong for a long period of time. He also recalled that even through uncertainty the firm was always believer in the sector in Europe, like proves the firm early bet in BTR in the UK.

Expecting a more severe capital growth impact, Antoni Sastre evidenced that for every 100 base points the office assets suffered a 20% correction on its valuation, and in his opinion, we still haven’t corrected the valuations entirely. Truth to be told, offices were probably the asset class where interest rates had the highest impact, to which sum up both the difficulty in access financing and the increasing requirements of tenants to improve the quality of these spaces (offices moving to a hospitality concept, with increased need of Capex).

In the same line, Carlos Becerril agreed that the fly to quality is undeniable and in the Insurance Companies strategies a purchase decision only moves forward if the asset fulfills three standard factors: location, quality, and ESG compliance.

Within a challenging crystal ball moment, the experts have launched their predictions for the 2024 results of the Spanish MSCI Property Index, which we know share exclusively with our readers.

EXPERTS FORECAST FOR 2024 SPANISH RETURNS:

- Most conservative return: 3.5%

- Most optimistic return: 8.0%

- Iberian Property estimative: 6.2%