Positive sentiment at Portugal Real Estate Summit confirms investment intentions in Portugal

International investors confirmed their interest for the Portuguese Real Estate summit, the largest Iberian real estate meeting, which took place at Estoril, during the 21st and 22nd of September.

The event featured 350 representatives from the Portuguese and foreign real estate industry, including investors from Portugal and Spain, France, Germany, Belgium, the United Kingdom, Israel, Brazil, India and Ukraine. The event’s main goal was to identify investment opportunities in Portugal, and in a wider perspective in Iberia, with a focus on the real estate segments.

Iberian Property estimates that real estate investment in Portugal has reached, since the beginning of the year, 1.76 billion euro, of which 60% (1.05 billion euro) concern deals concluded within the last two months.

More than 50% of the investors present at the summit, signalled that geo-politics are becoming a greater concern for their investment decisions, and only 2% stated their decisions were unaffected. These were only a few of the conclusions drawn from the interactive surveys carried out in real time during the event.

« We are clearly in challenging and uncertain times, but are we close to seeing the light at the end of the tunnel, or just at the beginning of a series of global transformation events? ». This was the question addressed by Roger Cooke, Conference Chairman, in the kick-off of the event, in which the sentiment for the real estate sector still seemed very positive, reflecting the safe haven nature of the sector.

«It's very difficult to look ahead to the horizon, we have many storms», thus it is better to look at prolonged trends because even if we are facing hiccups in between the long-term trends remain untouched, stated Pedro Siza Vieira, Former Minister of Economy.

On the economic landscape, Pedro Siza Vieira identified the end of an era – the “great moderation”. According to the former minister, there was some foresight globally, especially since the end of the cold war to which followed the implementation of institutions that forced trade activity together with the globalization phenomenon. «After 2008, we had a perfectly abnormal situation of negative interest rates. We got used to it, but it's not normal. And this "great moderation" is disappearing before our eyes», defended Siza Vieira.

In 2017, when Pedro Siza Vieira joined the Portuguese Government, there were already some risks, which materialised with the pandemic, such as large global dependencies, namely in terms of supply chain. And now with the conflict taking place in Ukraine, which subverts the world order achieved after World War 2, it finally became evident the European dependence on natural resources, namely from Russia. The global trust that supported the global economic context is disappearing, namely if the biggest economy does not trust the biggest exporter.

68% of those present believed that the geo-political and economic challenges we face today will remain in the medium term (1-3 years) and 14% even shared those challenges would be resolved in the short term, according to the interactive survey.

Closing its presentation, the former Minister warned that Portugal will have a difficult winter ahead. We will witness interest rates going up, and problems with demand. But Portugal is in much better shape to overcome a difficult time than it was 12 years ago. The economy is growing, in fact GDP has been growing above EU since 2016 (with only exception of 2020), and this year it is expected to have a growth of 6.5% in real terms, the highest in the EU – this strong economy performance is being led by investment and by exports. Just to give a clearer idea, in 2011 the value of exports was 13% of GDP, and between January and July of 2022 the value of exports was 47%.

6.5%Portuguese GDP is expected to have a growth of 6.5% in real terms in 2022, the highest in the EU

The sentiment of the privileged position Portugal might have for the future is shared by the two speakers invited to comment the prospects of “New Economic Horizons for Portugal”, Ismael Clemente, CEO of Merlin Properties, and Elizabeth Mathieu, Founder & Managing Director at South.

Elizabeth Mathieu referred that the major constraint that the biggest companies in Portugal are facing right now is related to the workforce, namely the shortage of people. And deeply connected to this, is the relation between the average salary and the average cost of housing.

On this topic, Pedro Siza Vieira commented that ten years ago Portugal had around 17% unemployment, and 450.000 people who left the country permanently, resulting in insufficient demand. What we are facing now is a different scenario of firms who have orders, they want to respond, but they lack the resources, and «compared to our previous reality that's an excellent problem to have».

Indeed, there is lack of resources, and this includes for example lack of unskilled staff. In this matter, it was completed an agreement to facilitate the circulation of Portuguese speaking countries citizens into Portugal, but of course we need to provide them then accommodation which is the critical issue because with the salary they get they cannot pay the house… «if we solve this then I think everything else will follow», stated Pedro Siza Vieira.

Inflation: to what extent can it be positive to real estate?

For Ismael Clemente, inflation will eventually also impact valuations. But the truth is that there will be a negotiation between landlords and tenants. And in the Merlin Properties’ CEO view «it's a shame that the government tries to intervene in markets that are ultimately self-regulating», and as such he also added that the markets are currently overreacting the magnitude of what’s happening.

Regarding the refinancing activity Ismael Clemente believes that companies without enough cash flow will face problems, especially binary models in which 80 or 90% of the value added was in the exit strategy. In REITS for example if the worst comes and “everything explodes” it is always possible to retain the cash flow and pay down debt just by retaining the dividend… that is technically possible although it is not desirable because there is a need to meet investors requirements (who want to receive their dividends). On the other hand, for private equity firms refinancing assessments are not going to be easy, just like highly indebted structures, and we must be mindful of what the ripple effect they could cause.

Elizabeth Mathieu agreed and highlithed that investors are starting to worry about the cost of debt, which changes very quickly today, and not so much about the source or type of funding.

Once again, the Portugal Real Estate Summit welcomed on stage the experts from several real estate consultants (Cushman & Wakefield, CBRE and Savills), who shared their insights in a dynamic session called “WORK, LIVE and PLAY”, a theme that addressed the main segments of the Portuguese real estate market.

Offices to have "record year" of occupancy

Regarding the office market, the ambition is for a "record year", «occupancy should break records and be the best year ever», said Eric van Leuven, Head of Portugal at Cushman & Wakefield, when addressing the "Work" part of the session. He also added that there are 500,000 square metres of new supply, half under construction, 73% pre-let.

The Head of Portugal at Cushman & Wakefield also stresses that the two main cities in Portugal remain "very attractive" both for the occupational and investment market, despite the lack of quality and adequate supply. The head of the consulting firm in Portugal, also highlights the fact that Lisbon is in fifth place among the countries where more jobs should be created in the office market.

"Flexible spaces are a theme, but still modest in the Portuguese market"

Speaking about the "new reality" that offices are going through, Eric van Leuven indicates that «hybrid working is here to stay, although there is no concrete data for Portugal» and flexible spaces are an option, however still modest in the Portuguese market.

In terms of logistics, «rents remain very competitive against the European market and much lower than other comparable cities. Yields remain high, there are good opportunities», says Eric van Leuven.

"Build to rent is not a trend, it is a necessity, especially for young people"

In terms of "Live", Paulo Silva, Head of Country at Savills Portugal, points to a "perfect storm", where «salaries do not keep up with the lack of supply and inflation. The average Portuguese cannot buy a house. All supply is absorbed by demand now. There is a huge gap between supply and demand». Build to rent thus becomes a necessity, especially for young people, indicates Paulo Silva, emphasising that 80% of young people up to the age of 29 live at home with their parents.

The Head of Country at Savills Portugal also highlights that there are new factors changing the offer, «new young people with lower income who can't get credit, more international workers and students are entering the equation. The millennials and future generations have other values». The so-called multifamily properties will set an investment record in Europe in 2022, however, none of this is happening in Portugal, says the Head of Country at Savills Portugal, adding that Build to Rent faces challenges, as the banks are not familiar with the traditional Build to Rent model, financing, construction, and land costs. Paulo Silva emphasises that «there are many opportunities to invest in Portugal».

Resilience of the hotel sector

After the pandemic we went through, the tourism sector has been recovering, an example of this is the "sold out events, new lifestyle concepts", refers Francisco Horta e Costa, Managing Director of CBRE Portugal, when addressing the "Play" topic. Referring that the pipeline of hotels remains robust, Francisco Horta e Costa also points out that the experience has been gaining importance in retail, which has adapted to online commerce, and sales are already higher than before the pandemic.

The weight of total investment in hotels is expected to increase to around 1/3 this year, indicates the Managing Director of CBRE Portugal, something that proves the fact that it is a resilient sector. In terms of retail volumes, these will "remain dormant", with retail «representing less of the overall investment compared to previous years».

On a more “relaxed” approach the audience was questioned about which song best summed up the actual moment for them, and the results demonstrate that 57% of the investors believe “times are changing”, and 15% remain extremely optimistic.

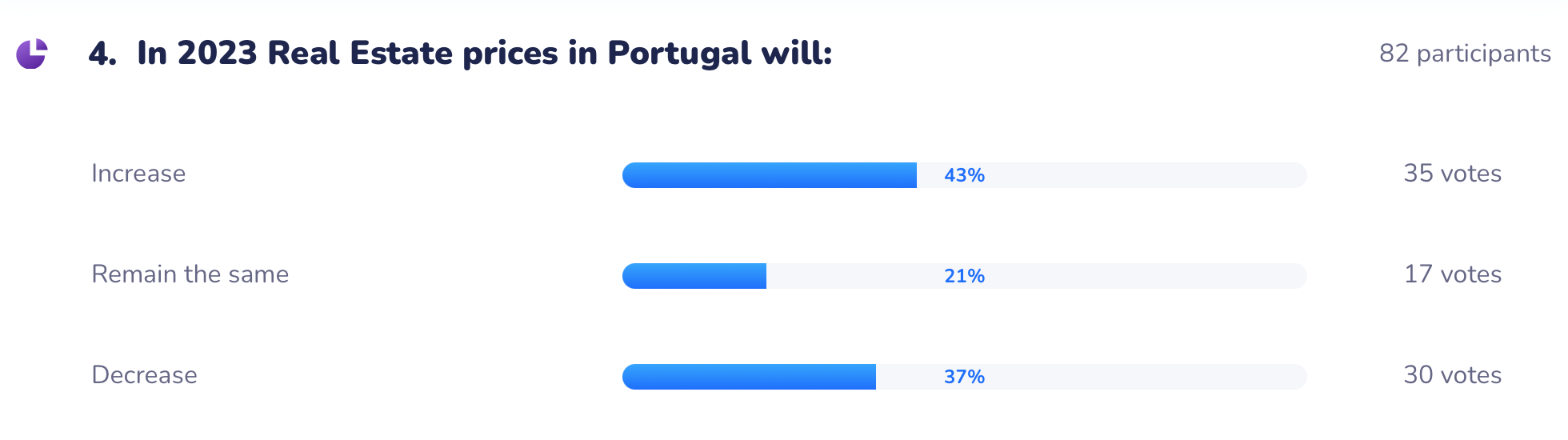

The investors present at the meeting also defended that Portugal continues to be very interesting to invest in, and despite the relatively small dimension of the market there are advantages that attract international demand.

Miguel Santana, Board Member of Fidelidade, stated that the insurance Portuguese group intends to maintain its current strategy betting on long income producing assets. As an example of their positive sentiment Miguel Santana mentioned the group’s commitment in the current development in Entrecampos (Lisbon) which will have both high end offices and housing.

Rui Vacas, Real Estate Director of Nhood, agrees and commented that «investors are looking for all ways of living, which can respond to the lack of supply that there is in Portugal». He also added that working with municipalities and getting support to deal with taxation issues are a key factor in the current scenario.

Investors rate: strengths and weaknesses when it comes to choosing between Portugal and other countries

From a pan-European investor point of view, Sameera Kolhatkar, Vice President of Blackbrook Capital, explained that investing across borders is always challenging, but «we've always found investing in Portugal to be very transparent, efficient and easy». For Blackbrook the only is the lack of supply, namely Grade A logistics stock, nevertheless «Portugal has historically presented good opportunities and we will continue to be active in the market».

Sharing the same opinion, Jonathan Willén, CEO of Europi Property Group, defended that «our experience in Portugal has been overwhelmingly positive, it’s a market with very strong fundamentals, and it's easy to transact». On a critical note, Jonathan Willén pointed out that Portugal is a slightly smaller market which in times of market distress can be less liquid, but «you do get compensated a little bit for that with higher yields, and in particularly strong occupational markets in logistics where we've seen really good operational performance». As a final remark, the CEO of Europi also added that the key for success is being creative to try and find the right opportunities in a smaller market, and «working with local operating partners is as much important as finding the right investment theme and finding the right assets».

"Lisbon and Porto are a team, not competitors"

Another of the themes of focus at the Iberian investment meeting was the commitment that the representatives of the two largest metropolitan areas in the country, Lisbon and Porto, presented to work for a whole and not only for their regions: «we are, above all, Portugal», stated Joana Almeida, Lisbon City Councillor.

For the city of Lisbon, Joana Almeida guaranteed that «the city wants to build more housing and attract more companies. We want to improve everyone's quality of life». For this, it is necessary that issues such as licensing, be simple and transparent, a matter in which Joana Almeida assured that the municipality wants to reduce waiting times and increase the transparency of the processes. «We understand that time is money», stressed the councillor.

Representing the municipality of Porto, Rui Monteiro, Director of the Municipal Department of Economics, highlighted the fact that the city of Porto is «one of the top three mid-sized cities for foreign direct investment. It is undoubtedly an economically competitive region». With the motto "Better Porto", the goal is to «take advantage of the economic landscape that already exists and stimulate certain sectors and regions. We have identified several key sectors, real estate and sustainable construction being two of them».

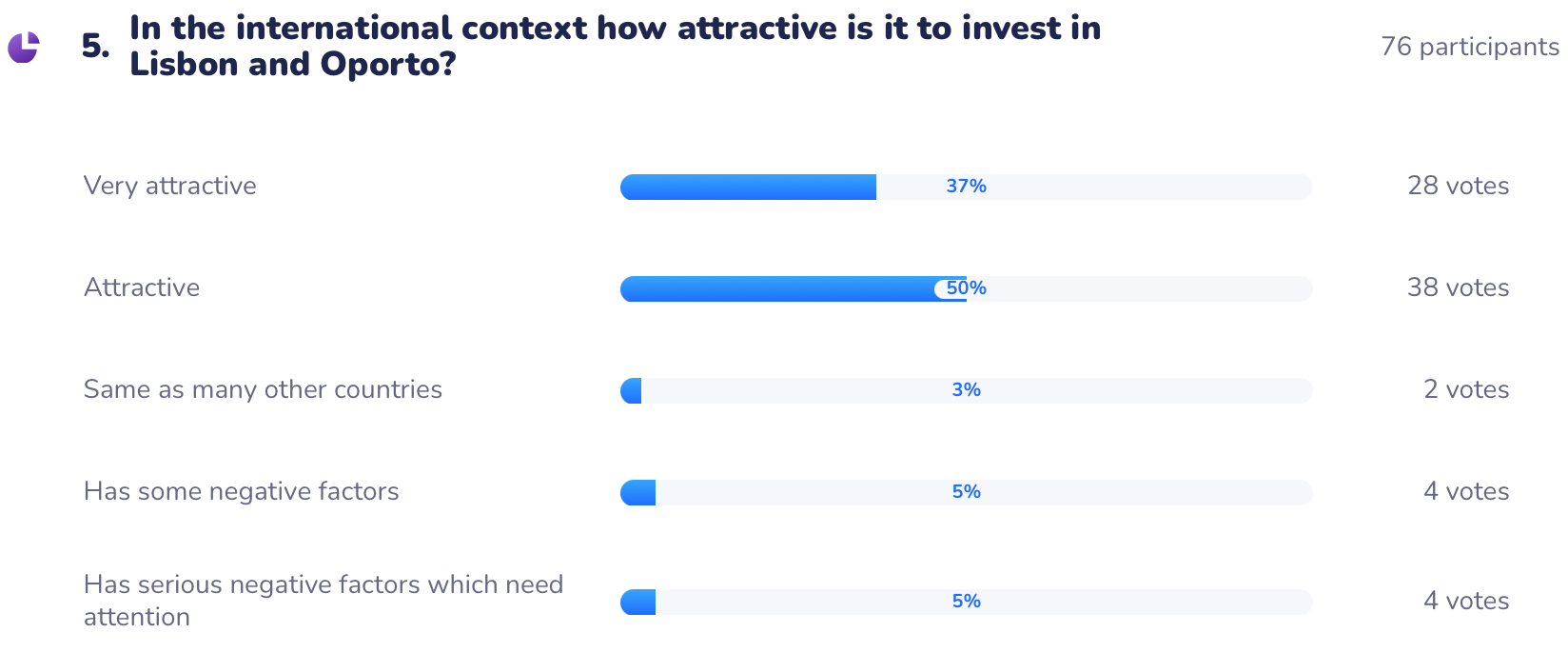

Based on the data from the survey of the audience present, of 76 participants, precisely 50% of people consider that Lisbon and Porto are attractive in an international context, while 37% declare that the two cities are very attractive in international terms.

In its 2022 edition, the Portugal Real Estate Summit had the support of Abreu Advogados, CBRE, Cushman & Wakefield, Delloite, Explorer Investments, Morais Leitão, Savills and Square Asset Management as its Main Sponsors. Norfin, Nhood, Merlin Properties, Grupo SIL, Reify, Fidelidade Property, GNB Real Estate, Engexpor, Broadway Malyan, Porto Municipality, Neoturis and C. Santos VP were also associated with the Portugal Real Estate Summit, supporting several moments during the event. Amongst the institutional sponsors were: ACAI, APAF, APCC, APFIPP, APPII, ASPRIMA, EPRA, RICS and WIRE PORTUGAL.