Lar España: the ten years of retail consolidation

How much can be changed in ten years? The song says that people will remain almost the same. But if we are talking about companies, especially real estate companies, that time span is a long time. If we also focus on the decade from 2014 until now, we are facing the most decisive stage in real estate. In that range, if there is a company and a sector that have consolidated in the last 3,700 days, the main candidates would be Lar España and retail, currently the most fashionable sector for investment.

The socimi Lar España was listed on the Continuous Market on 5 March 2014. It was the first IPO since 2011. The previous real estate company to go public had done so seven years earlier, when the global financial crisis of 2008 had not yet erupted. Its first day on the market ended with a 2.5% revaluation, after successfully closing a €400 million placement with institutional investors.

The decision to go public was the aspect that gave meaning to the whole project. That is why an Initial Public Offering, commonly known as IPO, was chosen. The message to the markets was clear from day one: this was a long-term industrial project that sought to professionalise real estate management and give it back a reliable and driving force for the economy as a whole. It wanted to be part of the Continuous Market for transparency and corporate governance, and also out of commitment to minority shareholders and the market as a whole.

As soon as the bell rang at the Palacio de la Bolsa, its chairman, José Luis del Valle, made the first definition of what they were proposing with this differential corporate model: "We are the first socimi to be listed on the four Spanish stock exchanges. We are going to invest in the Spanish real estate sector, especially in the commercial sector, to add value through long-term management. We believe this is possible at current levels of market maturity. We will achieve attractive returns and, for that reason, we have chosen to incorporate as a socimi and trust Grupo Lar as the exclusive manager. We believe it has experience in the management and development of real estate assets. We aspire to be the benchmark company in the Spanish real estate world of socimi".

A differential model

Since its incorporation, Lar España has departed from the usual tertiary real estate model, focused almost exclusively on the location of the assets. It preferred to focus on the quality of the assets themselves, and then on the ability to be complementary one by one, without acquiring batches of assets and becoming a sole owner. The aim was for asset quality and differential management to generate the maximum for shareholders, tenants and end customers.

From the outset, the company also took great care with corporate governance and social and environmental policies. It maintains transparent governance, with independent directors who are recognised and open to the various stakeholders. Financial and ESG reporting has been maintained at Ibex 35 levels, which in turn has enabled the company to obtain innovative and rigorous financing formats.

To date, it is one of the few Spanish companies in the real estate sector to have its entire portfolio of assets certified as sustainable construction, endorsed by Breeam. It was also the first real estate company to receive the Reduzco seal of approval from the Ministry of Ecological Transition and Demographic Challenge for the cumulative reduction in its carbon dioxide emissions. And the company complies almost entirely with the recommendations set out in the CNMV's Code of Good Governance.

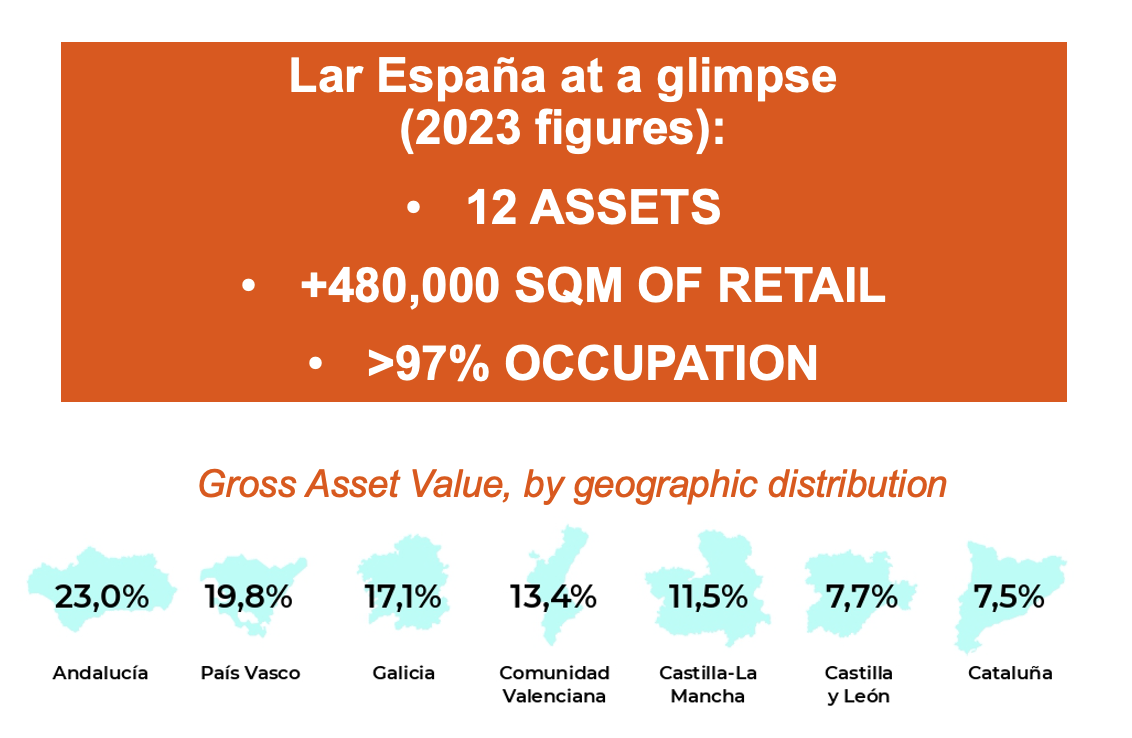

The funds raised through the IPO were invested in the Spanish tertiary real estate sector, mainly offices and retail. Over the years, the shopping centres and retail parks segment has become the sole focus of the Socimi's investments, with 12 top-quality assets worth more than EUR 1,300 million.

Long-term industrial vocation

The company has been characterised by having stable reference shareholders, within the logical and inevitable rotation, which in its case reaches almost 80% in a decade. The current range of institutional shareholders underlines this vocation: an interesting range. A second founding shareholder, a first shareholder who is a financial investor, long-term investors from sectors such as insurance and pension funds, and funds recognised worldwide for their policy of replicating indices.

In its first decade, the socimi has carried out two capital increases, in 2015 and 2016. In addition, in 2015 it issued the first guaranteed bond by a socimi, whose funds were key to completing the company's first comprehensive investment plan. In 2021 it completed two senior unsecured green bond issues, for a total amount of EUR 700 million, maturing in 2026 and 2028 and at a fixed interest rate of less than 1.8%.

It also completed three share buyback programmes. Between 2022 and 2023, it completed a EUR 110 million bond buyback programme at a discount of 18%. The nine meetings held so far have approved the distribution of EUR 392 million in dividends. The last of these, paid last May, distributed 66.2 million euros to shareholders, with a yield per share of 12.9% on the capitalisation at the close of the previous year.

The socimi has anticipated and led the recovery of a sector such as retail, which is the usual suspect but whose fundamentals provide both recurring income and a number of visits and purchases by end customers that continue to grow year after year. So far in 2024, investment in shopping centres and retail parks is showing clear signs of recovery. For the year as a whole, transactions worth between 1,000 and 1,500 million euros are expected, thanks to the fact that expected returns have grown, the uncertainty over the retail sector has been dispelled, financing is more accessible and Spain's economic outlook is positive.

The company through the eyes of seven experts