Investors present in the “WHY IBERIA?” agree it’s time to continue investing

Iberian Property and Real Asset Media co-organized the “IBERIAN INVESTMENT BRIEFING - WHY IBERIA?”, a half-day conference focused on Iberia, which brought together the real estate investment community in London, in the Nuveen Head Office, on the 18th of October.

After more than two years of the global economy constraints imposed, the main focus of the event was to discuss and share the latest research, strategies, and local market insights for Spain and Portugal, while highlighting the new opportunities as we move along the uncertainty of a prolonged conflict in Europe.

The first panel counted with the participation of Manuel Puerta da Costa, Chairman of APAF, and Miguel Ferré, Chairman of the Iberian Property Council, that presented a brief outlook of the Portuguese and Spanish economy, respectively.

Prospects point out that Portugal in 2022 will grow more than any country in Europe and Manuel Puerta da Costa recalled that the performance of two sectors are contributing in a very significant way: tourism and real estate.

For the Chairman of APAF, Portugal has currently some sectors that face increased pressures on the wage side, but there is political will to deal with the inflation, as is proof an agreement announced last week by the government to increase wages 5.1% in the coming year.

Strong deterioration of the energy balance

«Portugal despite this situation in Europe has not been impacted very much by the energy factor as the rest of Europe, and that is explained by the weight that renewables have in Portugal – more than 45% of the total energy is generated through hydro, solar, and wind – which has somehow avoided the problem not only on the cost side, but also on the external balance/dependency side», stated Manuel Puerta da Costa.

Regarding the Spanish economy, Miguel Ferré warns for the need to adapt the strategy since in the last years the country was enjoying a good environment of generalized economic growth, a reality that may change. Inflation is already having impact on the household consumption, and on the short term the financial conditions might get more severe.

However, on the positive side, the Spanish external sector is having a good performance (as in the Portuguese case), and Miguel Ferré also highlighted the energy autonomy of the country and above all having suppliers not affected by the conflict. For the future, natural gas can become even more important for the industry and families, and the strategic location of Spain can even give place to cooperation agreements with other European countries, like France, Germany, and also Portugal.

Last but not least, both speakers considered that the European Union funds are another topic worth studying, as the distribution of these funds are related to the size of the GDPs. To illustrate better, in the case of Portugal 60 billion euro will be attributed in grants, a number that equates to 30% of the GDP, and corresponds almost to what Troika lent the country back in 2011. «In times of uncertainty figuring out how to execute public spending and at what speed gains special relevance», stated Miguel Ferré.

Inflation and interest rates raising – what does it mean for real estate investors, and how are yields behaving?

For Manuel Puerta da Costa there is no doubt that interest rates matter. Investors are following closely what the ECB is doing, what the Fed started doing, and «the reason for that is linked to the fact that monetary conditions were too easy for too long… so I would say that interest rates will a negative impact on the coming year as long as inflation expectation do not change». If inflation expectations somehow in the coming 12 months decrease, there will be a reversal on the expectations on the future forward curves of interest rates, which would probably turn the very negative mood seen in several markets, such as the UK market, the U.S. market, and the central Europe market.

Miguel Ferré agreed on this matter, and he defended that when it comes to the Spanish economy the real estate sector will play a special role of “economic mechanism of activeness”. There are political concerns about the housing prices, but institutional analysis foresees a slight correction in this segment in real terms. In nominal terms, prices may still increase because offer is in low levels, and with construction costs rising developers are avoiding launching new projects.

Iberian Real Estate is facing 2 opposing forces

Following this Iberian economic outlook, Paloma Relinque, Head of Capital Markets at CBRE Spain, and Nuno Nunes, Senior Director, Head of Capital Markets at CBRE Portugal, shared the stage to present CBRE research regarding the Iberian real estate market fundamentals, while identifying the two countries main trends and investment opportunities.

Paloma Relinque stressed that inflation is in theory positive for real estate since rents are usually indexed to the CPI, and even with interest rates increasing «when we look to indicators like pricing per square meter we can see that investors can still make money and those who have bought assets a few years ago can still complete exit strategies with profits, so we expect that activity levels will remain more or less the same».

Both Spain and Portugal are living their best years in terms of investment volumes, with record levels in 2021, and a first half of 2022 quite strong. Nuno Nunes believes that this is partially explained by the fact that «Iberia got late into the train of the recovery, and so it is still lagging behind, which should put us in a more defensive position». Nevertheless, the disruption that we have seen on supply chains can help Iberia to conquer back industries, and to get closer to production centres, what's undoubtedly a good long-term position to be in.

“The existing stock does not respond to the current demand”

Speaking about interesting opportunities, Paloma Relinque highlighted the fact that Spain still has incomplete and/or obsolete stock in segments like the alternative living sector, where many of the assets were developed a long time ago and do not respond to the recent trends that appeared. Besides that, the management of the current stock is still sometimes on the hands of religious centres or public universities, which gives an additional opportunity to professional managers to enter the segment.

Concerning the Portuguese market opportunities, Nuno Nunes commented that «Portugal is still not there on the living sector, but there have been large transactions» reinforcing that the market fundamentals are good and the investors’ appetite to enter the segment is high. On the other hand, shopping centres were referred to as “underdogs” by the Head of Capital Markets at CBRE Portugal, since they are still performing quite well and most of them have already recovered to pre-crisis levels.

International trading taxation shouldn’t scare off investors

From a legal perspective, Pablo Serrano de Haro, Global Partner, Head of Tax at Clifford Chance, introduced some of the advantages concerning taxation for foreign investors to enter Spain, and on the same note João Torroaes Valente and António Pedro Braga, Partners at Morais Leitão, explained some of the main features when it comes to invest in Portugal.

Tax structuring has evolved throughout the years and Pablo Serrano explained how in Spain different type of investment vehicles and structures evolved to reduce the tax bill of the investors. The Head of Tax at Clifford Chance noted that 2012 was a turning pointing for the country because «when the real REITS regime entered in vigor was when the investment origin really became diversified».

The highlighted vehicle was the SOCIMI statute, for which Pablo Serrano explained that in some cases for rental income and for capital gain it’s possible to get a 0% tax rate. However, «each segment and client require and adapted solution, and when deciding which structure to adopt its important to analyse the investment plans and the expected returns».

When it comes to investing in Portugal, João Torroaes Valente identified private equity funds as one of the big trends of the last 5 years. Although private equity funds cannot have direct real estate investment, they can indirectly have real estate through SPV's, and this has been used notably for golden visa purposes. «Because private equity funds offer lower thresholds in terms of investment amounts, this has raised potential growth in this specific market of vehicles», explained João Torroaes Valente.

The second wave identified in the Portuguese market was the undertaking in a corporate basis through a closed SICAFI. António Pedro Braga, addressed to this structure as one of the “stars of the moment”, and going into depth he explained that «SICAFIs can enjoy the best of both worlds: they can enjoy an exemption which is very wide in relation to income received, for example income from the letting of spaces, leasing even shopping centres can be exempt under a SICAFI, and they also may benefit from the status of being a company, in regard to certain mechanisms and certain legal instruments; so we are seeing that interest from foreign investors is rising even in regard to SICAFIs».

Finally, the Portuguese REITS regime was also a topic of discussion, being introduced back in 2019 it has not yet been completely successful, there are only two examples in the Portuguese market, but as soon the regulatory and tax issues be resolved the SIGIs (Portuguese REITs) will have a lot of potential to growth, and it is expected that many family groups convert their companies into this statute.

“When you decide not to sell, you are actually deciding to buy”

After these three presentations, a round table discussion took place to analyse in depth where are the returns, which are the “hot” segment and cities, and to explore new trends. This panel counted with the participation of Pablo Álvarez-Rendueles, Director Real Estate Sector Coverage, ING Real Estate; Nuno Nunes, Senior Director - Head of Capital Markets, CBRE Portugal; João Torroaes Valente, Partner, Morais Leitão; and Carlos Portocarrero, Partner - Head of Real Estate Spain, Clifford Chance.

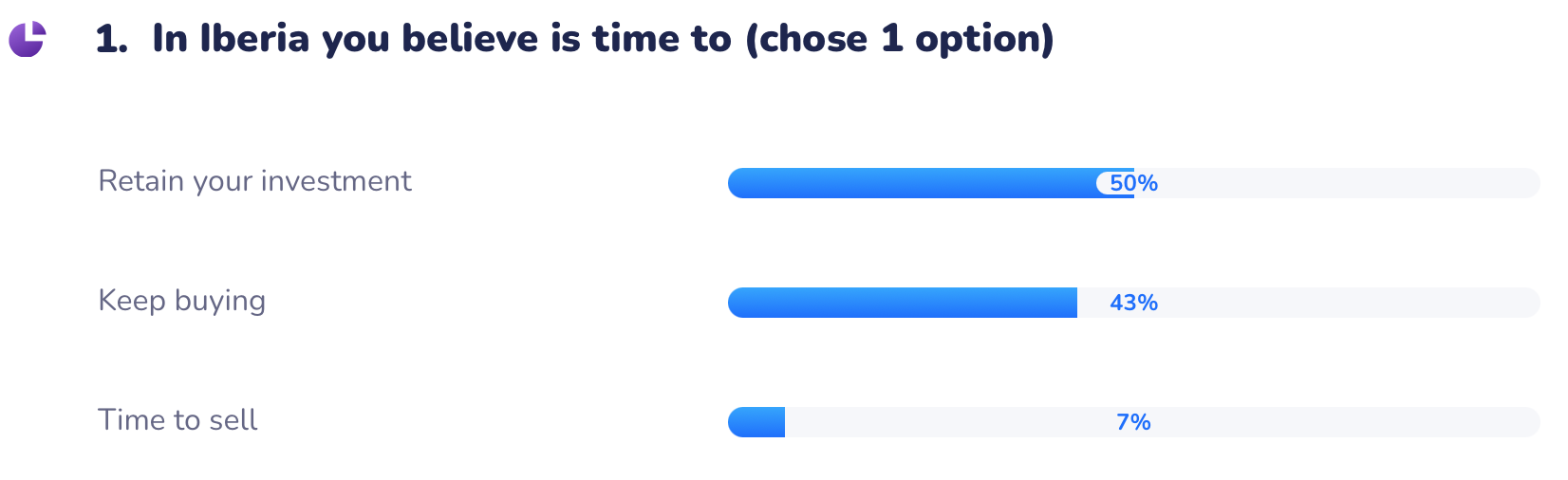

50% of those present believed that it is time to retain investments in Iberia and 43% even shared that now is the time to keep buying, according to the interactive survey.

Commenting on the online poll conducted during the session, Carlos Portocarrero shared that «when you decide not to sell, you are actually deciding to buy…you are keeping it because you expect the price to go up, otherwise you would sell». If we aplly that principle, it means that more than 90% of the audience believes that the market will go up at certain point of time.

Furthermore, the Head of Real Estate Spain at Clifford Chance added that institutional investors are to some extent happy, in the sense that this is now the time for them to invest. In Carlos Portocarrero’s opinion, now it's time for “people with muscle” to be in the market, and to select assets that might imply more complex and strategic structures, making significant investments to build a long-term portfolio.

From a financing perspective, Pablo Álvarez-Rendueles affirmed that the lenders are in a wait-and-see position, but fundamentals and portfolios remain healthy so far. «The margins have increased, the cost of financing has increased…and the so-called leverage is not leverage anymore, if you remove it, in some cases, the deals simply wouldn’t happen», stated Pablo Álvarez-Rendueles.

For Nuno Nunes, we are entering the “discovery stage”, which means that everyone is trying to understand how all this instability, interest rates, inflation, market disruption, and so on, will translate into a compounded effect, because at the end of the day no one wants to make the wrong decision. Nonetheless, «we're still seeing a lot of investors having positive inflows in their funds, other investors launching successfully new investment vehicles, so there is a lot of money out there».

Beside the fundamentals, the Head of Capital Markets at CBRE Portugal, calls the attention to the fact thatsince Iberia is under supplied in many sectors, even with some impact pouring down into the occupancy side, the fact is that in many asset classes there is no vacant space, and landlords can pass the increase cost of inflation to tenants.

On the closing remarks of this panel, João Torroaes Valente argued that we lack some optimist, «we haven’t suffered the hit, but we are already discussing it, and that doesn’t pose a good investment environment».

Retail and Logistics…. A view with a future?

The last moment of this event was stage to study in depth each segment main opportunities and fundamentals. Javier Martin, Senior Portfolio Manager, Nuveen, was responsible for the Retail and Logistics sectors, and started by pointing out that for these sectors, the important decision to make is related to at what price are we entering today an investment, something difficult to assess with a general negative sentiment across the market.

With focus on Logistics, the Senior Portfolio Manager of Nuveen argued that the deal adversity is increasing a lot, meaning that a sharp correction may lie ahead. Nonetheless, Iberia presents good infrastructures and corridors that connect the peninsula to other countries either by air, land, or sea, and that also connects its own main cities, with special mention to the strategic relevance of Lisbon and Porto for Portugal, and Madrid, Barcelona, Valencia, and Málaga for Spain.

Another highlighted aspect was related to the current the stock, which on Javier Martin opinion is quite outdated. This gives room for developers to become more active and to bet on secondary locations like Bilbao or Victoria where demand is strong, and the absorption of new developments is made quite fast.

On Retail, Javier Martin affirmed that yields are indeed way higher than in Logistics, as are the prime real estate prices of shopping centres, supermarkets, and high street units. «The interesting thing about retail, when compared to logistics, is that the management is quite more interesting and, while on the second you can come from 100% income to 0% quite fast, in retail you might have 100 tenants, and you have the challenge to coordinate different commercial mix, you have long term leases, there you can ask for higher rents, and you develop new strategies to improve long-term income».

Nuveen emphasized that Retail can see a lot of operations being closed until the end of the year, especially through institutional capital, and on the rising stars Retail Parks were outlined as “very interesting” due to the inferior need of Capex that other retail assets require.

Office: still the preferred core investment?

Pedro Coelho, Vice Chairman of the Board, Square Asset Management, presented a clear view of the challenges the office segment face. «Companies can work from home, but it’s not going to be the base case! ». Pedro Coelho enhanced the fact that the cities where the time of commuting is higher are the cities where the return to offices is being done in a slower pace.

Another important trend underlined was the increase of companies establishing themselves in Iberia, together with the number of people also moving there to work. The stable rents are growing quite significantly, and demand remains high on the 4 main cities: Madrid, Barcelona, Lisbon, and Porto. On the other hand, yields are coming down, probably due to the increase of interest rates and inflation.

Residential: a new must to have?

Jorge Pereda, Rental Residential Director for Iberia at Grupo Lar, introduced the Multifamily sector as a “new must to have”.

Demand is strong and is growing, and it's still away from any kind of a European average. In Spain, today figures say that rental versus owner occupied homes have a rate of 25% but in 2007 it stood at 19%, which is a huge growth, even though still far from the European average which is 31%.

And the problem is crystal clear: lack of production capacity. Currently Spain has 24 million dwellings, where 4.5 million are for rent. If it were to reach the European average, it would require 1.1 million new homes for rent – at the current capacity of development, which is about 80,000 units a year, it would take over 13 years to cover this demand, assuming that demand doesn't grow. With this said, Jorge Pereda defended that «there's a pretty big room for improvement and for investment, and there's a big need for this kind of product».

In terms of investment figures, covering that 1.1 million units for rents would translate into more than 200 billion euros investment channelled to the living sector, and this means that there is room for more players jo enter the market, which in Jorge Pereda’s opinions is still “extremely incipient”.

As final remarks, the Rental Residential Director for Iberia of Grupo Lar stressed that «the living segment has proven to be very resilient in terms of uncertainties, being the best performing asset class during the global financial crisis of 2008, and even with rents adjustment the occupancy doesn’t quite fall back because people at the end of the day needs somewhere to live».

The opportunity in Leisure Hospitality

Tourism has become a global mega trend, accounting for a high portion of the global GDP. Every year people are travelling more, and tourism accounts for 75% of global travel being business responsible for the other 25%.

Javier Mallo, IR, Corporate Development and Strategy Director at Azora, stressed that hospitality in Iberia, in both Spain and Portugal, is still very fragmented, with many hotels still on the hands of families or small chains, leaving room for consolidation, repositioning and to add professional management to those assets.

Javier Mallo argued that Leisure remains a secure investment particularly in “sun and beach destinations” which are already performing above the 2019 levels in terms of ADR’s (average daily rates), RevPAR’s (revenue per room), and in terms of occupancy. «The story is different for urban destinations, what is motivated by the lack of group business travelling…it’s true that offices are important, but the cultural change is there, some meetings will continue to be made through a quick videocall».

Furthermore, the Strategy Director of Azora defended that in this segment the witnessed increase in revenue is still compensating the current inflation and energy costs increases, and activity should remain high.

Macro-Development project in Iberia - The "Valdecarros" example

Also worth mentioning is the presentation by Luis Roca de Togores, President of the Valdecarros Community Council who started by mentioning that, according to the Madrid City Hall projections, the Madrid region will double the GDP growth foreseen for the Spanish total, and that is only possible because Madrid has a local government very business friendly, with a loose policy of economic conditions for companies to be able to move projects ahead.

According to the Madrid City Hall website the average demand of housing for the last 10 years was 33,000 units per annum. Now, considering that in the great Madrid region the available stock stands for 27,000 units, and a new building takes around two years, what we really have is a demand of 66,000 units versus an existing stock of 27,000, a clear supply shortage. Valdecarros will host the largest programmed development to respond to this shortage, specifically giving birth to more than 51,000 units.

1/3“Valdecarros will be developing one in each three units in Madrid for the next 20 years”

Out of those units, 28,000 will be subsidised homes, what means that they will have a maximum price established by law, while the remaining 23,000 is allocated to what we call free housing – no maximum price applied. Besides the housing purposes, the development will also count with 139,000 sqm allocated to light industry, 36,000 sqm for offices, and 30,000 sqm for retail (in the format of a shopping centre). In terms of sustainability, the macro development will add to the city 6.9 million square metres of green areas, therefore complying with the latest standards for the products in terms of sustainability, environment, and ESG.

Finally, Luis Roca de Togores accentuated that 36% of the property of the whole development belongs to the regional and local government, what demonstrates the commitment of the public authorities towards the Valdecarros development.

The investors present in the room still had the opportunity to pose questions in a final round table discussion with regard to the outlook, pricing, risks and opportunities in both the traditional and alternative sectors, benefitting this way from high-level market insights.

IBERIAN INVESTMENT BRIEFING - WHY IBERIA? was sponsored by CBRE, Clifford Chance, Morais Leitão, Nuveen Real Estate, Square Asset Management. The event also counted with the following institutional sponsors: ACAI, APAF, APFIPP, APPII, ASPRIMA, EFFAS, EPRA, REFINITIV, RICS, WIRES. Vida Imobiliária, Observatorio Inmobiliario, Confiencial Imobiliário, Idealista, and UrbanOvation acted as Media Partners.

Presentations (pdf):