INVESTMENT IN SPAIN STANDS HEALTHIER THAN EVER

These figures were calculated from an analysis of the Iberian Property Data© database, based on public information, which identified a sample of 255 investment operations carried out in Spain in the first nine months of 2022.

Looking at the track record for the last three years, this analysis concluded that the real estate investment in Spain has fully recovered and is now on a continuous growth path. The cumulative results until the 3rd quarter of 2020 did not surpass 6.3 billion euros, approximately 9% below the more than 6.96 billion euros invested in the country during the same period in 2019. If we compare it with the figures of 2021, we already see a y-o-y increase of 31%, with around 8.24 million euros being channelled to the country. Finally, this year we are witnessing a breaking record pace for Spanish real estate investment, with 255 operations adding up to more than 12.19 billion euros (a y-o-y increase of 48%).

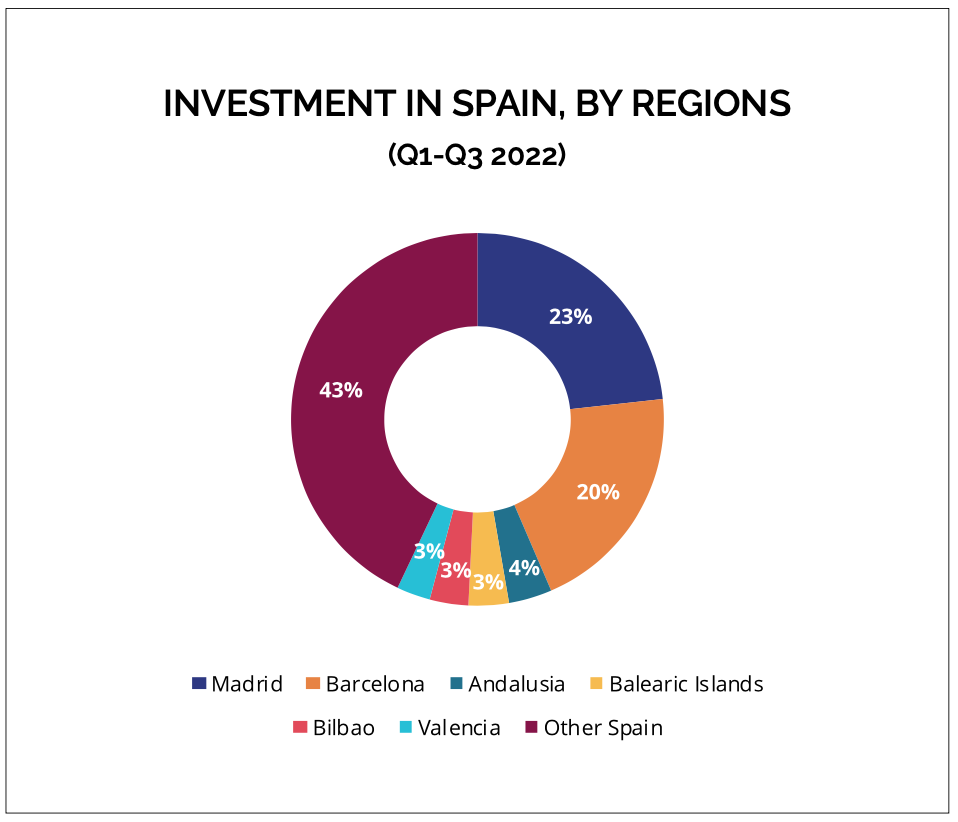

Madrid attracts the most investment

Comparing the performance in different Spanish regions, Madrid stood out the most during the period under analysis. Amounting to 2.83 billion euros, the volume invested in this region until the 3rd quarter presented a significant increase in annual terms, surpassing by 70% the 1.66 billion euros registered one year before. However, this growth in the Madrid market still compares downwards (-3%) with the pre-pandemic period, with the amount traded in the first nine months of 2019 standing at 2.93 billion euros. Worth noting, the number of operations carried out in Madrid in the first three quarters of the year steeply recovered after a continuous decrease over the last three years, going from 63 in 2019 to 58 in 2020, 46 in 2021, and now reaching 96 deals in 2022.

By contrast, the data gathered by Iberian Property Data shows that Barcelona suffered a slight deceleration in terms of investment volume, despite the persistent increase in the number of deals carried out in the first nine months of the year: 29 in 2019, 37 in 2020, 48 in 2021, and 50 in 2022. Standing at 2.47 billion euros, the cumulative investment in the first three quarters of 2021 compares downwards (-6%) with the 2.62 billion euros registered during the same period in the previous year.

Excluding these two regions, the next mention goes to the Andalusia region, attracting 458 million euros – with special highlight to Almería which attracted around 188 million euros, followed by Malaga with 99 million euros – corresponding to a share of 4%. Balearic Islands shown a great investors’ appetite for hotels, what resulted on a share of 3% of the total investment in Spain, with 9 operations amounting to more than 425 million euros. With very close values Bilbao also assured a share of 3%, with 5 transactions that amounted to 409 million euros. Valencia attracted more than 350 million euros (3%), with 21 operations completed.

The rest of Spain displayed a strong annual growth in the cumulative investment until September, both in the number of operations and the amount traded, to 5.23 billion euros, which is partially explained by several portfolio transactions that involved assets located across all Spain.

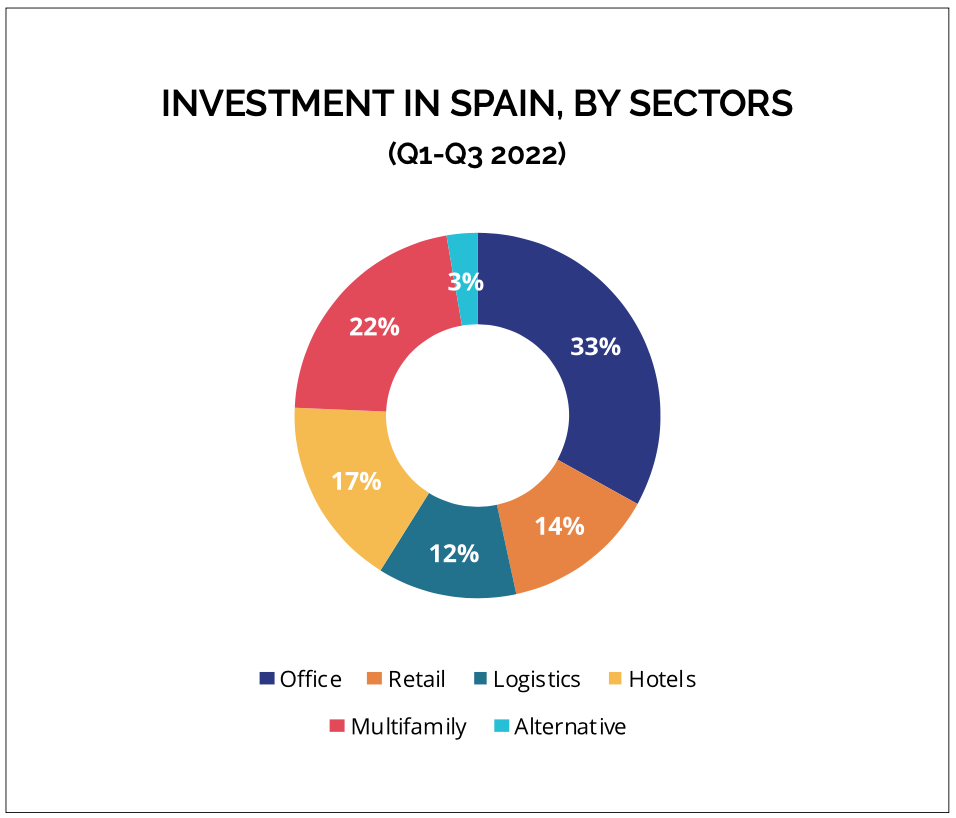

Offices investment more than doubles

When the time comes to allocate their capital to different asset classes, comparing 2022 with the dominant pattern in the pre-pandemic period the Iberian Property Data© analysis shows a strategy similarity. If in 2019 (Q1-Q3) offices and retail were the major stars of real estate investment in Spain, leading the podium with, respectively, 45% (3.17 billion euros) and 17% (1.20 billion euros) of the total investment, followed by hotels in 3rd position with a share of 12% (784 million euros), in 2022 the scenario is quite close, with only the second position of the ranking belonging to a different sector.

Firstly, there is clearly a greater balance between the amounts allocated to the different asset classes. More than doubling the volume of capital attraction offices take the lead at ease with 4.03 billion euros (33% of the total), followed by multifamily (2.63 billion euros, 22% of the total) and hotels (2.04 billion euros, 17% of thetotal). Retail is off the podium for the second consecutive time since Iberian Property started tracking this series, with a share of 14% and 1.65 billion euros invested (21% y-o-y growth) which, nevertheless, bring it to 4th position on this ranking. Logistics comes next, in 5th position with a 12% share and 1.50 billion euros invested. Finally, Alternatives come in 6th position, with 332 million euros traded and a share of 3%.

Alongside these changes in position, we note the exponential growth in the total amounts allocated to Hotels, Multifamily and Logistics between 2019 and 2022, reflecting the importance these assets classes have gained among investors in the wake of the pandemic.

On one hand, the last months have been marked by great momentum in hotel investment. Since tourism was one of the economic sectors most negatively impacted by Covid-19, various institutional and private investors are now capitalising on this opportunity, positioning themselves to, given the better conditions, add to their portfolios assets in this sector that were not even on the market before. The data is clear: after the capital allocated to this asset class more than doubled (+142%) in the last year, from 785 million euros until the 3rd quarter of 2020 to 1.9 billion euros at the end of September 2021, there was still room for increase and to surpass the 2 billion investment mark in 2022. Looking back before Covid, the growth in 2022 was 247% compared with the 827 million euros invested until the 3rd quarter of 2019.

The pandemic also seems to have had a positive effect on the investment in multifamily, which increased more than 600% between the 3rd quarter of 2019 (7% of the total) and the 3rd quarter of 2022 (2.63 billion euros). Inside this sector Residential attracted the largest amount (1.14 billion euros), however the greatest ‘leap’ was registered in the Student Housing segment, which this year attracted approximately 1.12 billion euros (also a 9% share of the total). Senior housing captured almost 200 million euros, translating in 2% of the total investment.

After emerging as a ‘winner’ from the Covid-19 crisis, benefitting largely, among other factors, from the boom in e-commerce, the investment in logistics decreased this year, from 1.61 billion euros in 2021 to 1.50 billion in 2022, nevertheless it remains way above the levels of 2019 (789 million euros).

Institutional capital continues to be the most predominant

In 2022 institutional capital – represented by Asset Managers & Investment Funds (37%) and Insurance Companies & Pension Funds (9%) – continues to dominate the Spanish market, leading 46% of the investment in the country, or 5.64 billion euros. This year, Asset Managers & Investment Funds closed deals valued at 4.53 billion euros, 3% more than the 4.39 billion invested during the same period in 2021, while Insurance Companies & Pension Funds reduced the amount invested during the period under analysis by 273%, from 404 million euros at the end of the 3rd quarter of 2021 to 1.10 billion euros accumulated until September of this year.

However, we highlight Commercial & Investment Banks which, in the last year, increased its investment in the Spanish market by 253%, from 902 million euros in the first nine months of 2021 to 2.28 billion euros in the same period in 2022 (correspondent to a share of 19%).

€1.84BREITs & SOCIMIs channelled the most investment (of the last 5 years) to the Spanish market, namely undertaking 50 operations that amounted to 1.84 billion euros

After losing ground as buyers three years in a row – 577 million euros invested in 2021, a decline (-22%) from the 738 million euros invested the year before, and 1.25 billion euros during the same period in 2019 (-54%) –REITs & SOCIMIs have now channelled the most investment of the series Iberian Property track, namely undertaking 50 operations that amounted to 1.84 billion euros, placing this listed companies in the third position of the podium.

By contrast, Private Equity lost ground, dropping to the fifth position of the ranking with a 6% share (738 million euros). Following next, with 19 transactions completed End User companies invested 556 million euros (5%), Family Offices invested 373 million euros (3%) in 18 operations, and development companies were responsible for 2% of the total investment.

Between January and the end of September 2022, 159 active investors were identified in the Spanish market (24 less than in 2021), of which 72 are Asset Managers & Investment Funds, 7 Insurance Companies & Pension Funds, 28 SOCIMIs & REITs and 12 Private Equity entities. We note it was not possible to determine the type of investor in 13 deals valued at 378 million euros.

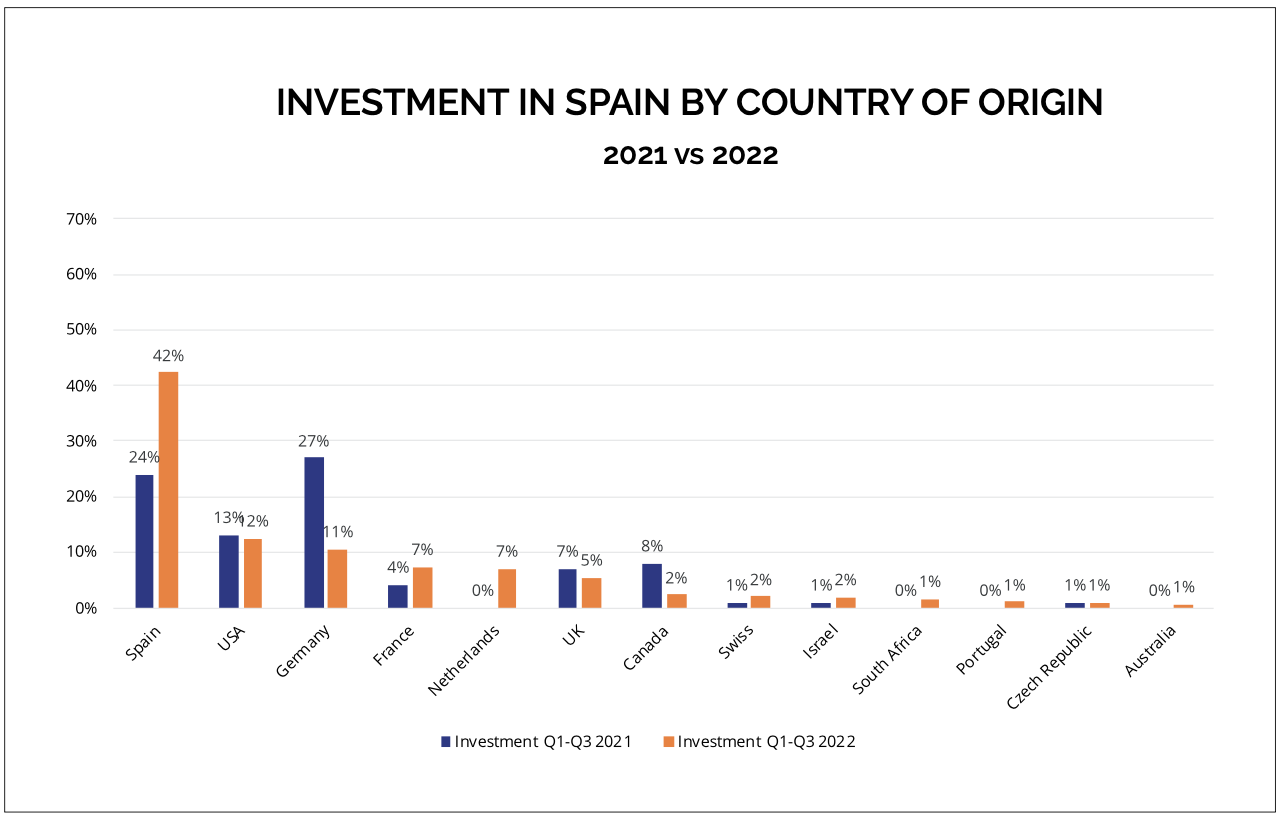

21 nationalities are active buyers

The analysis of the Iberian Property Data© database identified 13 nation- alities among the buyers that were active in the first nine months of 2022 (three more than one year ago). Represented by 77 entities, domestic investors were responsible for 42% of the total amount traded in the country, spending 5.16 billion euros in 107 deals, 263% more than the 1.96 billion euros spent during the same period in 2021.

USA buyers were the second nationality who spent the most on real estate asset purchases in Spain between January and September 2022: 1.50 billion euros distributed across 33 operations performed by 18 in- vestors, in other words, 12% of the total (44% more than the 1.04 billion euros they spent one year before). The third most active nationality in 2022 was Germany, represented by 13 entities, with 1.28 billion euros that represent a share of 11%, dropping 73% from the 2.22 billion euros allocated until September 2021, also losing ground and the lead from the 27% share attained last year.

The French were also active this year, with 18 investors closing 27 operations valued at 888 million euros, an increase of 269% compared with the 330 million euros allocated during the same period the previous year. One of the newcomers since 2020, the Netherlands were the 5th most active nationality in Spain in the first nine months of 2021, representing 7% of the total amount allocated, namely, 850 million euros invested by a single entity. The UK practically equalled its performance from last year, with 14 investors leading 21 operations valued at 607 million euros. Canadians channelled approximately 283 million euros through 2 entities, with this country’s investment being reduced to more than half compared to last year.

Although to a lesser extent, Switzerland, Portugal, Czech Republic, Switzerland, Luxembourg, Italy, Sweden, Belgium and Austria were the remaining European nationalities that invested; joined by Mexico, Ven- ezuela and Brazil, representing South America; Israel, standing for Asia; South Africa represented Africa; and Australia from Oceania.

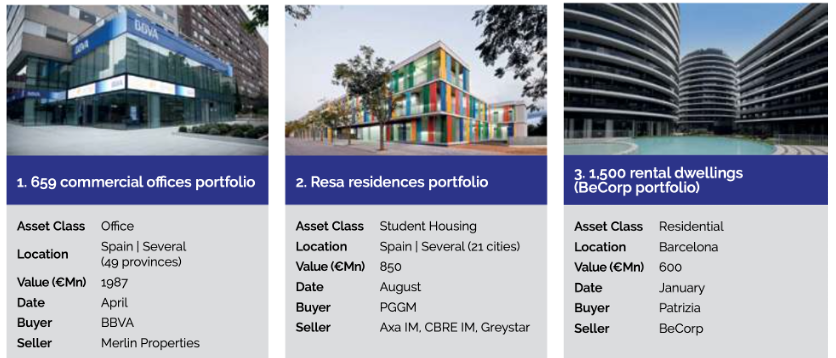

TOP 3 DEALS IN SPAIN (Q1-Q3 2022)