CAPITAL MARKETS HEAT UP WITH THE SUMMER

These figures are from Iberian Property Data, whose database calculated more than 250 operations for the purchase of income assets in Iberia between January and the end of August 2021, totalling an overall value of more than 12.74 billion euro. Of these, the largest share (86%) was allocated to the Spanish market, where 207 operations were identified during this period, involving approximately 10.98 billion euro. Portugal captured the remaining 14%, equivalent to around 1.76 billion euro in 46 operations concluded until August.

Capital markets speed up in July and August

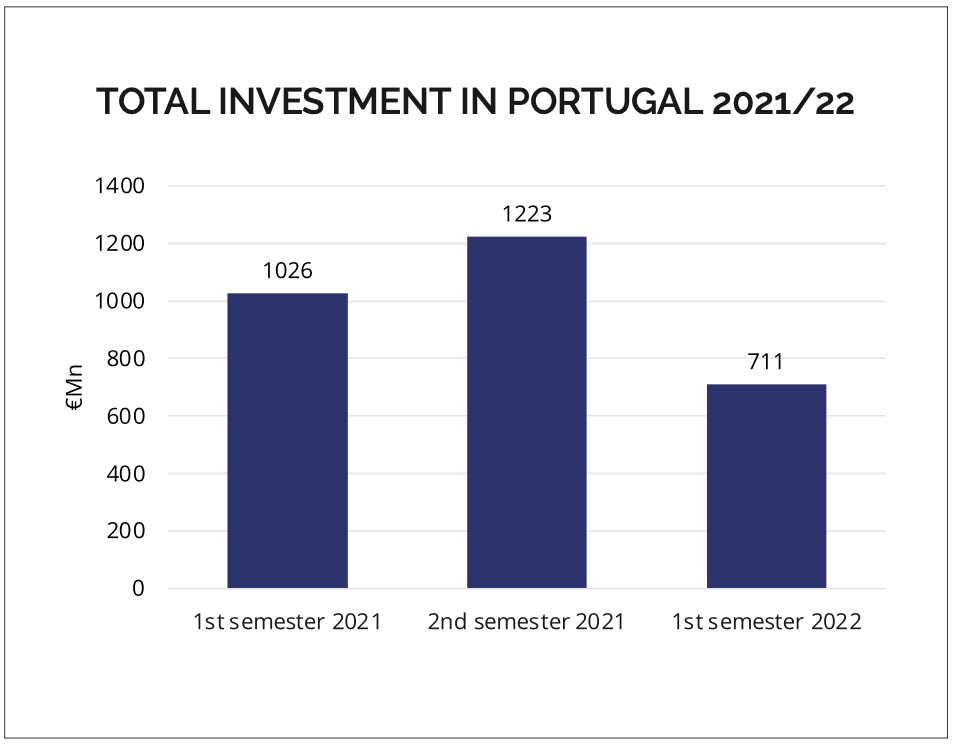

Analysing the data gathered by Iberian Property over the last 18 months, there is a positive recovery of the investment volume channelled to Portugal. In the first half of 2021, the second national lockdown constrained the activity of the sector, nevertheless important portfolio transactions were closed surpassing the 1 billion euro target during those first six months of the year. The second half that followed materialized the peak of the recovery and more than 1.2 billion euros were invested in the country.

The beginning of 2022 brought new international challenges that once again threatened to place investors in a “wait-and-see” position. Altogether the total value of the 38 deals completed in the first half of 2022 reflected a y-o-y decline of 31% compared with the volume invested in the 1st semester of 2021. However, during the first six months of the year the pipeline of important deals to be concluded was extremely high anticipating a record breaker third quarter.

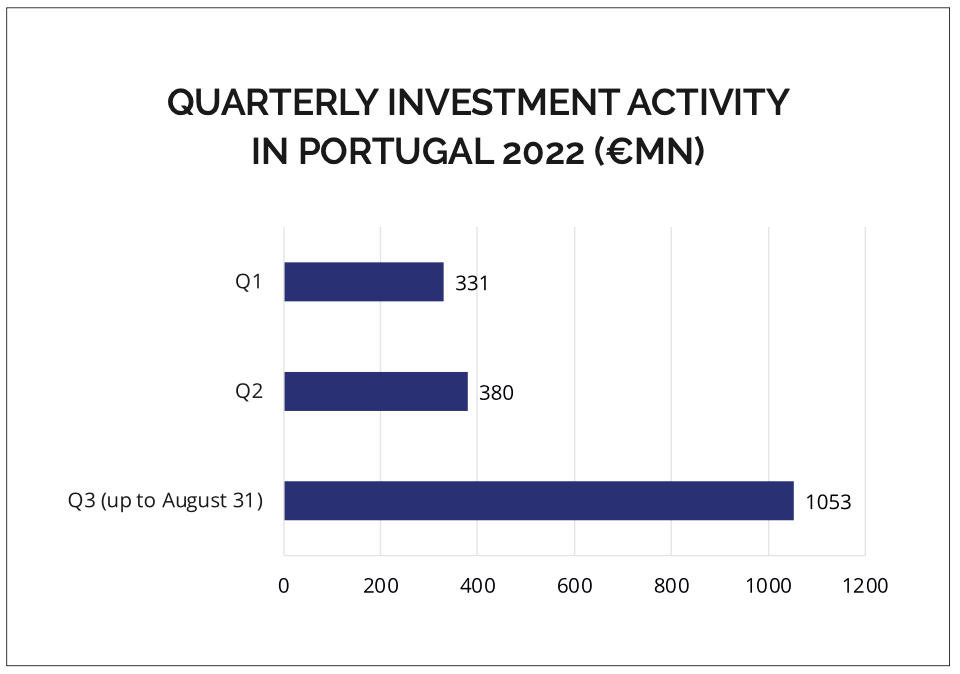

Confirming the predictions, from July onwards there was a clear acceleration of investment in Portugal, and, at the end of August, the 3rd quarter already recorded 9 operations and approximately 1.053 million euro invested. Therefore, with one month still to go, this was already the most dynamic quarter of the year, presenting a performance 277% above the 380 million euro traded during the 2nd quarter (22 deals) which, in turn, already represented a growth of 15% compared to the 331 million euro registered during the 1st quarter (16 operations).

Lisbon attracts the largest share of capital

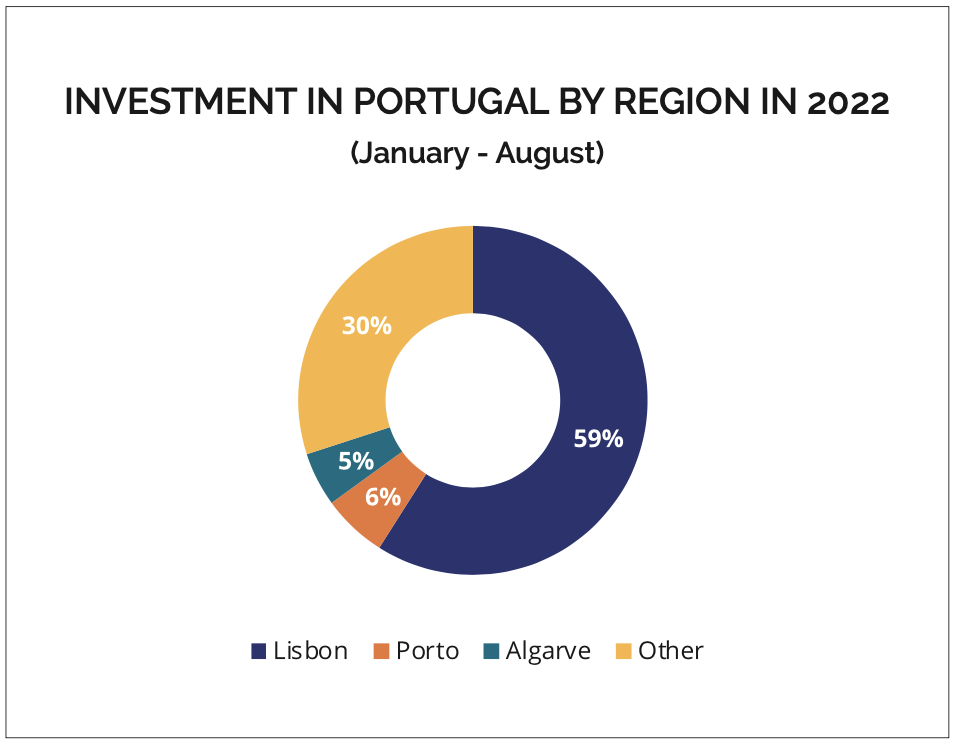

Lisbon’s market’s behaviour was clearly the main force for real estate investment in Portugal, attracting 59% of the total amount traded dur- ing the first eight months of 2022, equivalent to more than 1.035 million euro, also leading the number of operations (24). This figure represents an increase of 64% compared to the 631 million euro invested in 2021 in the region (corresponding to a 53% market share).

Contrarily to what has been identified by Iberian Property’s analysis over the last few editions, the greater diversification of investment targets that was evident throughout 2021, did not apparently transited to 2022, and the second largest city in the country, Porto, dropped considerably the total investment share attracted in 2022 (6%), registering approximately 98 million euros whereas in the same previous period it had captured approximately 167 million euros, 14% of the total.

The Algarve region also suffered a significant step back in capital attrac- tion during the first eight months of the year. While last year the region proved to be the great revelation with nearly 189 million euro invested, in 2022 this figure stands at 90 million euro achieved in 3 operations, placing the region in third place with a 5% share.

The remaining 30%, or 540 million euros, channelled to real estate investment in Portugal until the end of August was distributed across the rest of the country, what can partially be explained by some large portfolios transactions whose asset locations could not be identified.

Spanish and North Americans invest the most, after the Portuguese

International capital continues to dominate, representing 75% of the investment carried out during the first eight months of 2022, with 1.3 billion euro, against just 445 million euro led by Portuguese investors, which represent the remaining 25%.

€1.3BUntil August, 9 different nationalities were identified among the foreign buyers investing in Portuguese capital markets.

Until August, nine different nationalities were identified among the foreign buyers investing in Portuguese capital markets. With shares of 24% and 24%, respectively, Spanish (427 million euro in four deals) and North Americans (400 million euro in three operations) were the most active nationalities, directly behind domestic investors. The United Kingdom comes next, with two operations valued at 245 million euro that led to a 14% share. Germany came in fourth among the foreigners, with a single operation that amounted to 100 million euro, representing a share of 6%. Mozambique and China were responsible each for a share of 2% of the total investment, the first with 42 million euro invested, and the second with 40 million euro. At the bottom of the list are France, with an operation worth 16 million euro, and a corresponding share of 1%. Turkey and South Africa were the last nationalities identified, responsible each for one acquisition, but of diminutive importance.

Institutional capital continues to make headway

Portuguese real estate continues to be perceived by institutional capital as a safe investment destination, representing 43% of the total volume traded until August. Among these institutional investors, we identified 16 Asset Managers & Investment entities that undertook 22 operations with a total value of 679 million euro, representing 38% of the cumulative investment. In addition to these, Insurance Companies channelled a total of 85 million euro (5%) to this market, in four operations.

The analysis by Iberian Property also identified 375 million euro invested by 4 Private Equity institutions, in a total of 5 operations that earned them a 21% market share.

REITS & SOCIMIs, carried out two operations (one of them by a SIGI the Portuguese version of REITs and SOCIMIs), involving just over 312 million euro, resulting in a share of 18%, a figure quite remarkable compared to the previous years, analysed by Iberian Property.

Closing the investor type analysis, End User companies channelled over 195 million euro (11% share) in two operations. Family Offices and Development companies were responsible for 2% and 1% of the total investment, respectively.

There were also five operations with a combined share of 3%, where the identity of the buyer was not disclosed, therefore it was not possible to identify the type of investor.

In terms of the average ticket per operation, REITS & SOCIMIs investors take the lead with 156.1 million euro, followed by End User companies, with 97.8 million euro, Private Equity investors with 75.1 million euro, and behind, Asset Managers & Investment Funds with 30.8 million euro.

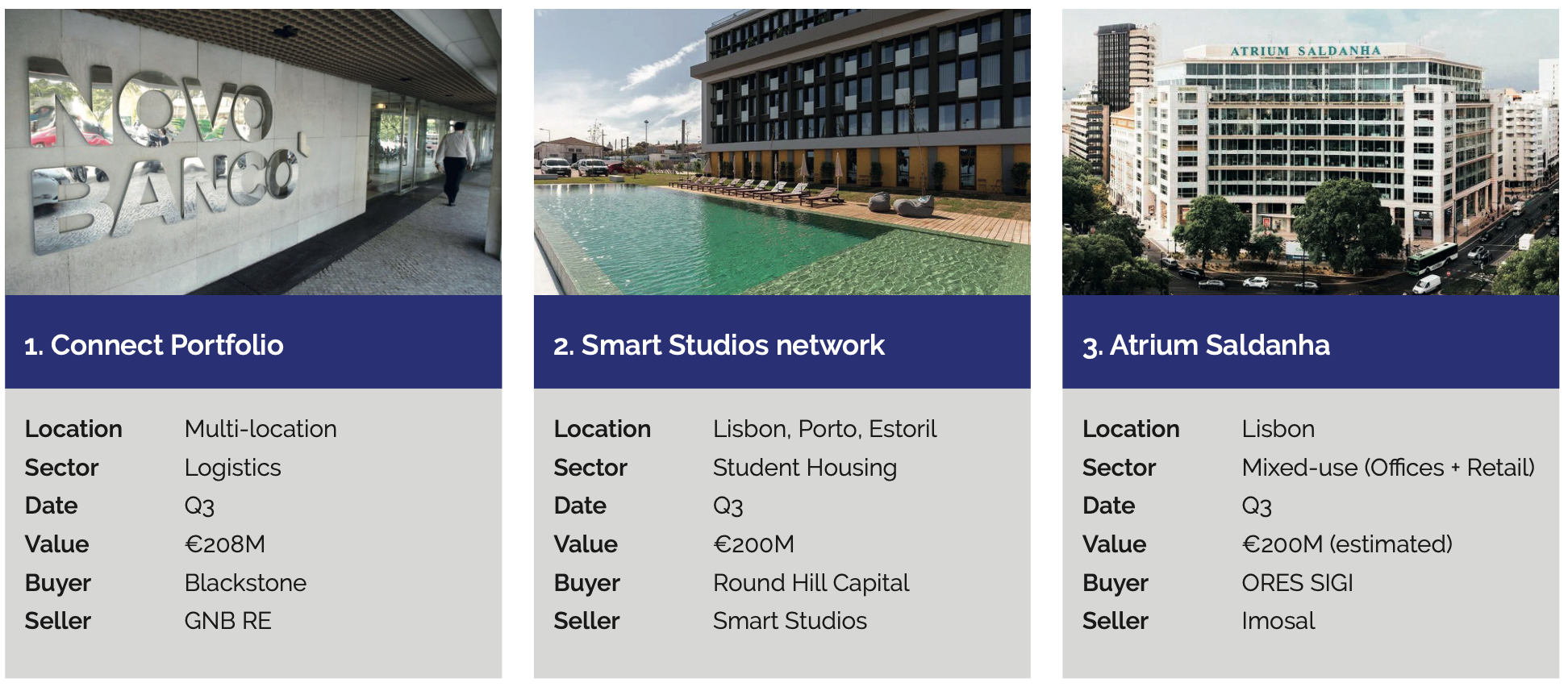

TOP 3 DEALS IN PORTUGAL (Jan.-Aug. 2022)