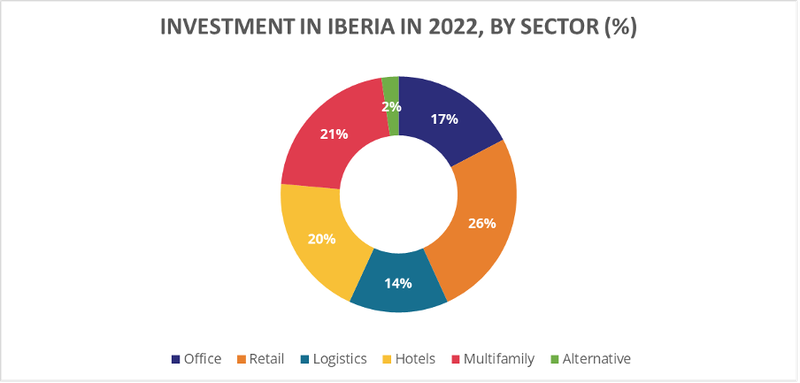

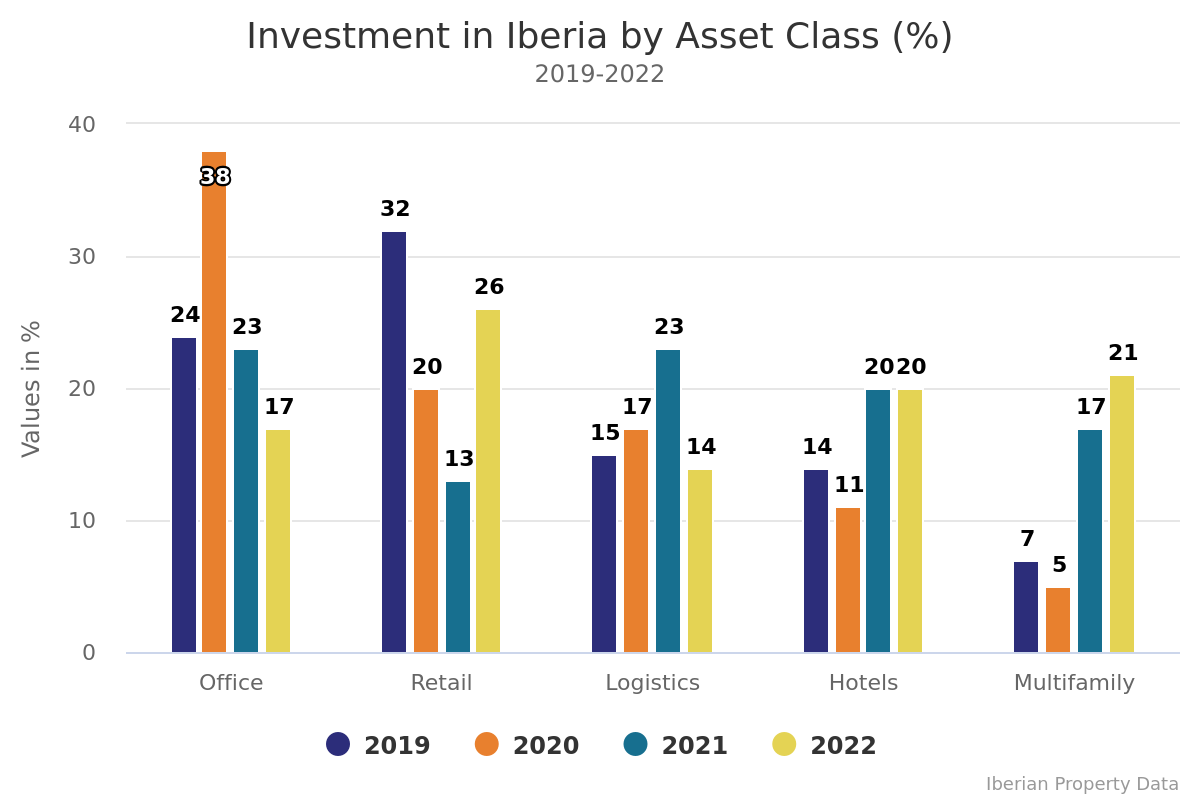

This figure represents an increase (+170%) from €1.78 billion traded in this asset class the previous year, doubling the sector’s share from the 13% held in 2021, which relegated it to 5th position in the ranking.

A sign of changing times, the multifamily segment went from 4th place in 2021 to 2nd in 2022, attracting 21% of the total investment, the equivalent of €3.94 billion euros. This result represents a y-o-y growth of more than 63% from the €784 million traded in 2021, and an increase of 4 p.p. compared with the share of 17%.

Maintaining their position from 2021, hotels close the podium in 3rd position, achieved thanks to an investment volume of €3.64 billion in 2022, 20% of the total. This performance surpasses by 29% the €2.83 billion traded one year before, although the market share remained stable.

Meanwhile, offices dropped from the 1st position (23%) in 2021 to 4th place in 2022 (17%), with the accumulated investment in this sector registering a slight decrease (-2%), from €3.27 billion to €3.22 billion.

The investment in Logistics assets decreased 14% during the period under analysis, from €3.17 billion to €2.54 billion, with this sector’s market share shrinking 9 p.p., from 23% in 2021 to 14% last year, leaving the 2nd position to occupy the 5th place in the ranking by asset class.

Likewise, and maintaining the trend initiated in 2020, alternative assets lost ground again in 2022, with the amount invested going no further than €436.87 million euros, in other words, 19% below the €538.45 million obtained one year before. As a result, this segment’s share halved from 4% to 2%, with this asset class once again at the tail end of investor preferences.