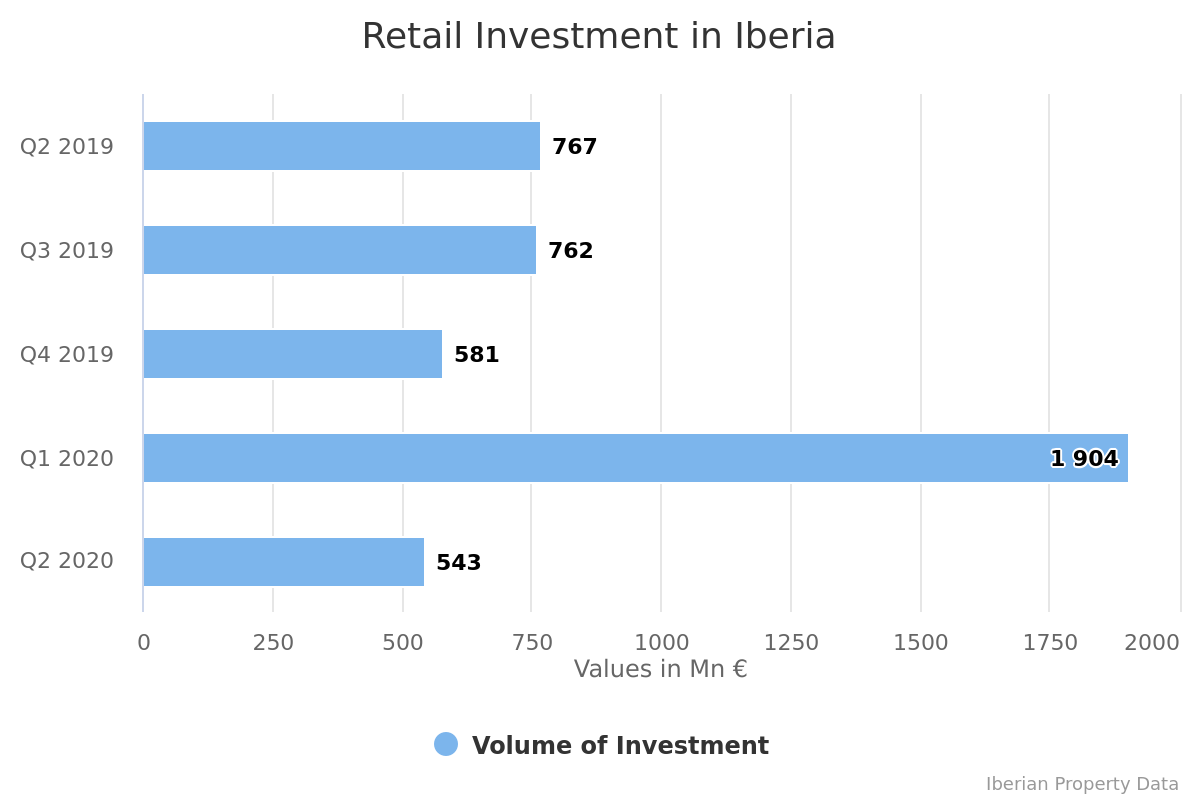

Retail investment in Portugal and Spain dropped almost 30% y-o-y during the second quarter. This is one of the effects the pandemic crisis had on this market.

Between April and June, a total of 11 retail deals were concluded (2 of them for undisclosed amounts), totalling around 543 million euro. But it should be noted that almost 88% of that amount, 475 million euro, concern one single operation: the sale of 50% of the Puerto Venecia Shopping Centre by intu to Generali and Union Investment.

The Retail Iberian Property Report concerning the second quarter revealed that the second largest operation was 20 times smaller: the sale of the Trindade Domus building’s retail area in Porto, by Substância Numérica to Portuguese Finangeste and British Patron. The prevalence of small deals during this period marked by the pandemic is very clear, since 5 of these were traded for less than 10 million euro.

When compared to the first quarter, the drop is even bigger: -71%. But it should be noted that the 1.9 billion euro invested in retail until the 31st of March was the largest amount invested during a single quarter last year. The transaction of intu Asturias for 290 million euro in January and that of Sonae Sierra 6 shopping centre portfolio for around 800 million euro may explain this record.

All the information is available at the Retail Report from Iberian Property which can be downloaded HERE.

For more information on how to subscribe to the Iberian Property Data service, click HERE.

Disclaimer: This information is based on public data gathered within the platform Iberian Property Data. All estimates were calculated based on registered public information and data from the main consultants within the market. It should be noted that the results presented here may be updated if new information is issued.