This result was estimated by Iberian Property Data©, whose database identified a sample of 421 real estate investment operations completed in Iberia throughout 2022, totalling €18.6 billion euros, representing an annual growth of 67% in the number of transactions (251 in 2021) and a 33% increase in the capital invested (€14 billion in 2021).

Therefore, and consolidating the recovery initiated last year, capital markets have surpassed the pre-pandemic performance, overtaking by 22% the previous record of €15.2 billion attained in 2019, a year when 288 investment operations were concluded.

Capital markets grew at a higher rate in Portugal

Reflecting the size of each market, unsurprisingly the largest share of capital (84%) was traded in Spain, with 350 operations amounting to a total of €15.5 billion, while Portugal attracted the remaining 16%, valued at a little over €3 billion euros. However, it is interesting to note that both countries maintained stable shares compared with 2021, although Portugal presented a higher growth in annual terms, surpassing by 39% the €2.2 billion registered the previous year. In the Spanish market, the growth was 32%, compared with €11.8 billion traded one year before.

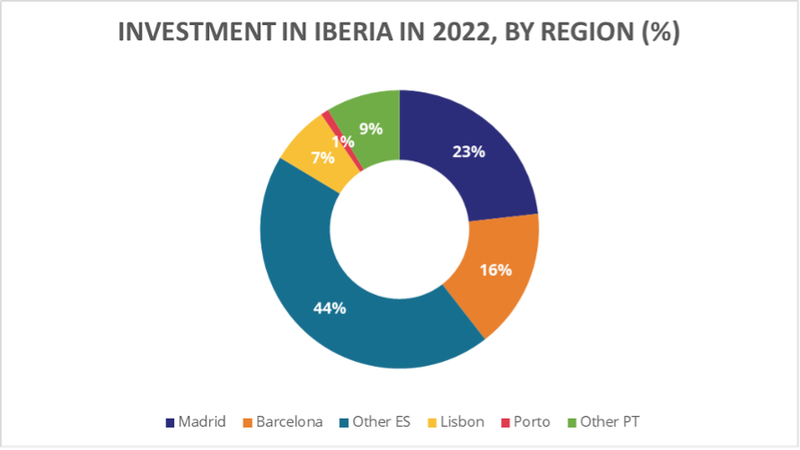

Looking in greater detail, the Madrid region stands firm as the undisputed leader of Iberian investment, attracting 23% of the total amount traded, namely €4.3 billion euros, followed by Barcelona, with a 16% share and the equivalent of a little over €3 billion, and only afterwards Lisbon, with 7% and almost €1.3 billion. In addition, another €8.2 billion were traded in Other Regions of Spain, approximately 44% of the total, and €1.6 billion were traded in Other Regions of Portugal, representing 9%; aside from €172 million in transactions in the Porto region, with the second largest city in Portugal representing just 1% of the total amount.

Compared with the previous year, the Catalonia region, led by Barcelona, lost some ground, with this region’s share reducing eight percentage points (p.p.), resulting from a y-o-y decrease of 11% in the investment volume (€3.4 billion in 2021); and the same occurred in Porto, which displayed a decline of 2 p.p. from the 3% share held in 2021 (€370.2 million). In the case of Lisbon, although the capital allocated to the region grew 18% in annual terms, the region’s share of the Iberian market as a whole dropped 1 p.p. from the 8% share achieved the year before. In contrast, Madrid’s share increased 4 p.p., compared with 19% in the previous year. Other Regions Portugal saw their share climb from 5% to 9% during the period under analysis, resulting from a 116% growth compared to the €736.7 million invested in 2021, while the share of Other Regions Spain presented a slight decrease of 1 p.p. compared with the 42% share achieved the previous year.