This data is by Iberian Property Data ©, with the database identifying a total of 41 investment operations in commercial properties in Lisbon between January and December 2021, amounting to more than 1.14 billion euros. These indicators represent a decrease (-9 operations) from 50 deals monitored and around 2 billion euros (-42%) traded in the city one year before. Likewise, the average ticket per operation also dropped, decreasing almost 30% during the period analysed, from 39.6 million euros to 27.9 million euros.

With the start to the year marked by the second general lockdown and aggravation of the pandemic crisis in the country, Lisbon’s market presented less momentum in the 1st semester, closing with an investment volume of 523 million euros. The arrival of the summer brought renewed momentum, attracting a total of 619 million euros throughout the 2nd semester. In both semesters, portfolio transactions were a constant in this market last year, and Iberian Property estimates that this type of deal represented approximately 46% of the investment allocated to the region, namely around 525 million euros.

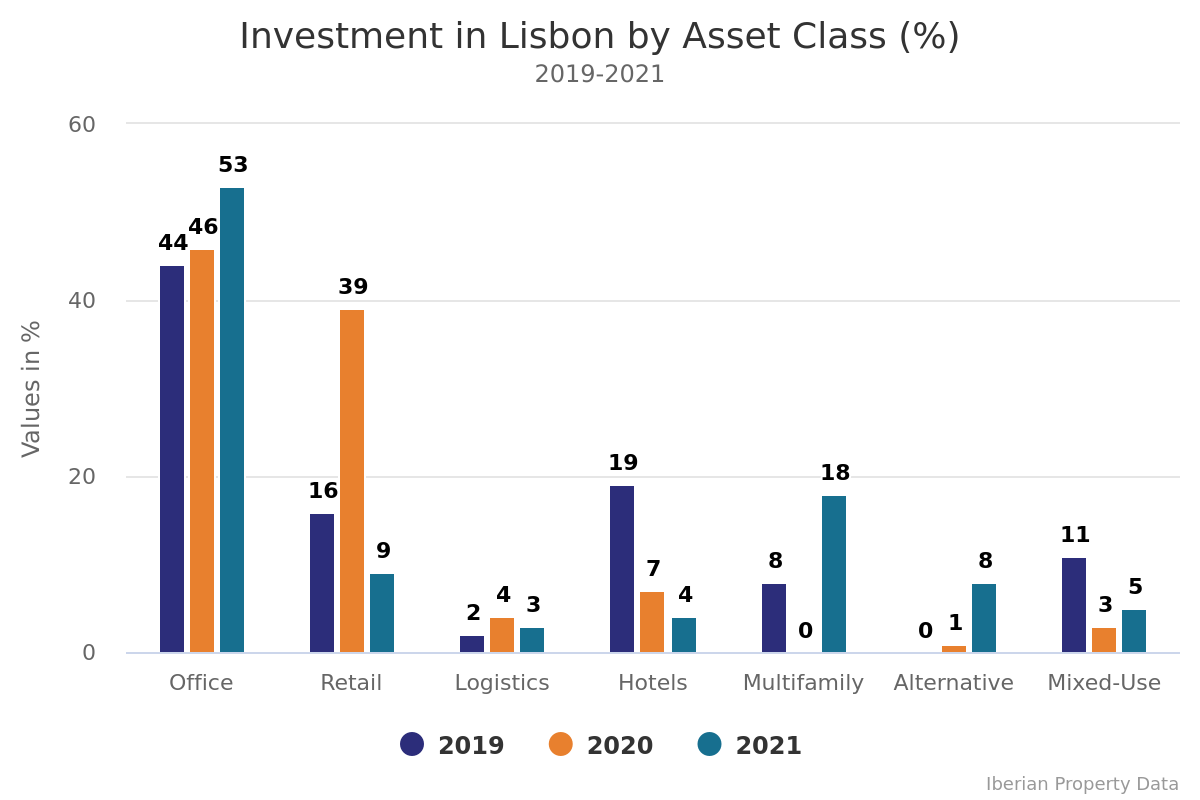

Offices dominate investor preferences in Lisbon

Offices continue to dominate investor preferences in Lisbon, attracting 53% of the total invested in the region, equal to 609 million euros generated by 17 operations. The largest deal in this segment was the purchase of a portfolio of 15 buildings located at Quinta da Fonte, for which Sixth Street paid around 150 million euros. Although it maintained the lead on the podium, in 2021 this asset class saw its investment volume drop -32% y-o-y, compared with 902 million euros registered in 2020, and decrease -30% from the 864 million euros traded in 2019, before the crisis.

Gaining new momentum, the Residential/Multifamily sector was the second most dynamic asset class in the Lisbon region in 2021, obtaining a share of 18% by attracting more than 200 million euros through five operations. Valued at a total of 333 million euros, the ZIP portfolio alone – which was one of the largest dealsconcluded in the country last year, involving the purchase by the Tikehau/Albatross consortium of a portfolio of 4.435 units distributed across the country – added approximately 120 million euros to these results, as this is the value Iberian Property estimates for the circa 1.600 residential units located in the Lisbon region.

In contrast, Retail lost ground in 2021, presenting sharp declines both in the investment volume (to less than 100 million euros) and market share (close to 9%) compared with the performance one year before, when this asset class represented 39% of the total investment in Lisbon (amounting to 702 million invested in eight operations).

The Alternatives segment now appears in fourth position, after an upward trajectory driven by transactions of assets in the healthcare industry, representing 8% of the total traded in Lisbon last year, around 89 million euros.

Although this was one of the most dynamic asset classes across Portugal, occupying third position, specifically in Lisbon, Hotels saw their share drop for the third consecutive year and, after shrinking from a 19% share in 2019 to 7% in 2020, in 2021 this sector represented just 4% of the region, registering only 46 million euros generated by three operations – in other words, the investment volume was almost three times less than the 137 million euros recorded in 2020.

Finally, Logistics comes last on the list, representing 3% of the total investment in the region, the equivalent of 32 million euros, losing share compared with the 4% obtained in 2020 and presenting a y-o-y decline of almost 58% compared with the investment of 76 million euros registered last year.