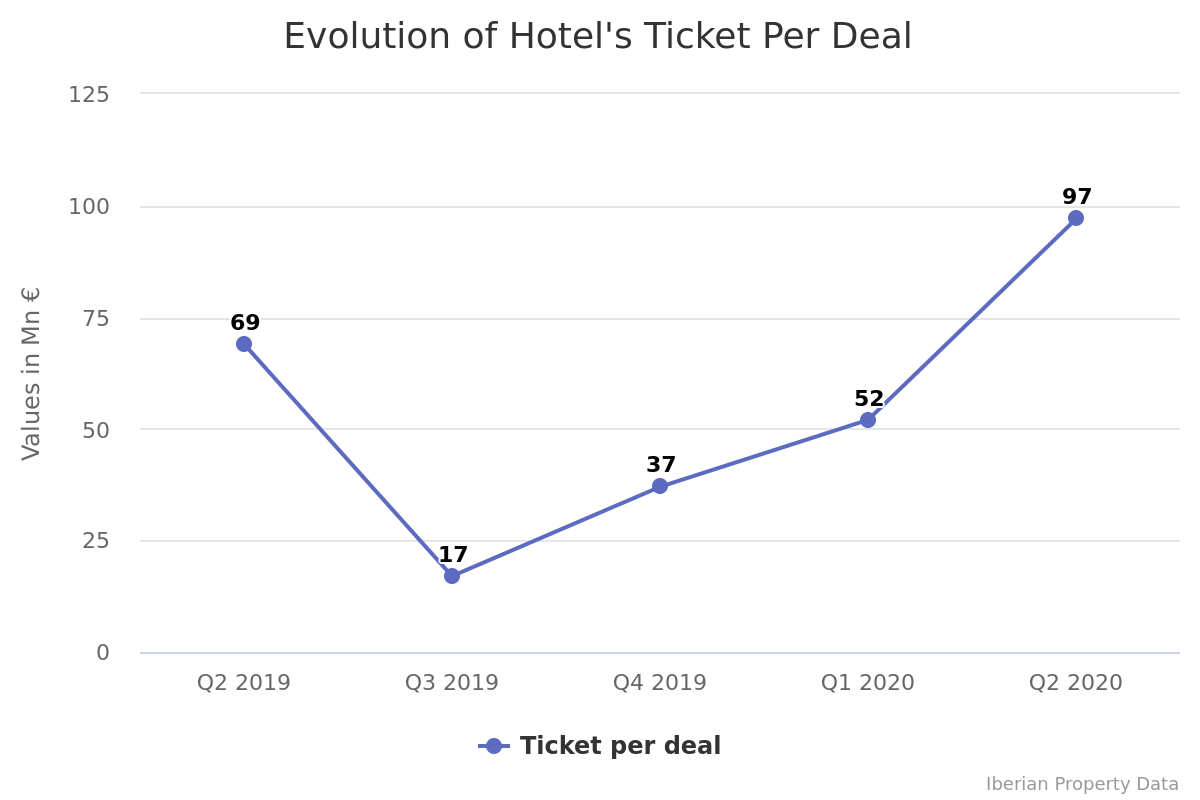

The drop in hotel investment was confirmed by the data compiled between April and June, which showed a 65% y-o-y drop. But they also showed that during the second quarter the ticket per deal surpassed all values registered during the last year.

The 97 million euro amount is the result of spreading 291 million euro in investment across only 3 operations carried out during this period: hotels H10 Punta Negra, Abora Buenaventura and Hotel Himalaia Baqueira, which were traded during the worst of the pandemic, when their occupancy rate was close to 0%. The conclusion of these operations, which were all above 50 million euro, reflects the fact that only large hotel deals were carried out during this period.

The Iberian Property Hotels Report concerning the second quarter also showed that this ticket per deal is 40% higher y-o-y and almost double the value registered during the previous quarter, when 15 hotel operations were concluded for lower amounts. Nevertheless, the first quarter registered 790 million euro in hotel investment, 63% above the second quarter.

In terms of the segment’s share over the Iberian real estate market, the same report showed that there were no significant changes during the last 4 quarters. It is still worth noting that, despite the setbacks caused by the pandemic, the hotel segment’s share increased 2% reaching 15%.

All the information is available at the Hotels Report launched by Iberian Property, which can be downloaded HERE.

For more information on how to subscribe to the Iberian Property Data service, click HERE.

Disclaimer: This information is based on public data gathered within the platform Iberian Property Data. All estimates were calculated based on registered public information and data from the main consultants within the market. It should be noted that the results presented here may be updated if new information is issued.