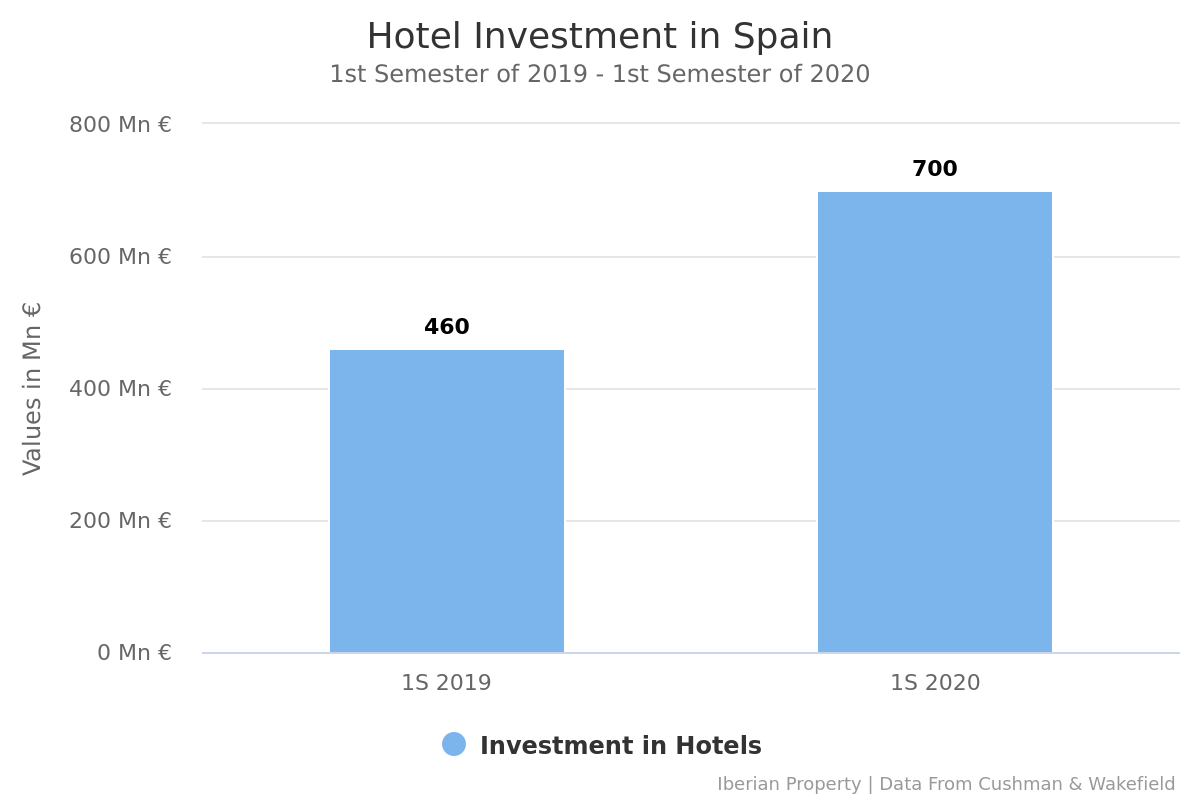

Even with Europe ravaged by the pandemic, hotel investment remains strong and in Spain it actually increased 52% reaching around 700 million euro during the first semester.

Although around 59% of those 700 million euro were invested between January and March, during the second quarter, with the country under confinement, 2 major operations were registered: the purchase of the Mallorca H10 Punto Negra by hotel chain Madarin Oriental for around 135 million euro and the acquisition of the Abora Buenaventur in Las Palmas by Apollo Global Real Estate for 103.2 million euro. Besides these operations, one other stood out during the first quarter: the sale of Hotel Edition Madrid by KKH Properties to Archer Hotel Capital for 220 million euro. This was the largest hotel transaction carried out in Spain during this period.

Hotel transactions kept the good pace with «minimum price adjustments», but, according to Albert Grau, partner and co-director at Cushman & Wakefield Hospitality in Spain, the mismatch between investors’ expectations and assets’ values might decelerate investment in the coming months. «Investors keep showing interest, but are waiting to obtain larger discounts in order to act, which may take place by the end of the year or at the beginning of 2021», he explained.

The latest data issued by Cushman & Wakefield also showed that there is «a growing interest in tourist complexes amongst investors, boosted by the positive growth prospects on the long-term concerning leisure travelling, as well as the recovery expected for this segment after the Covid-19 crisis, in terms of business and conference demand».

For Albert Grau, «the difference between the 2009 financial crisis and the current one is that now there is capital available on the market. We believe that during the last quarter and next year the market can be boosted by the appearance of interesting opportunities in destinations where up until now there was no product, or if there was, it was too expensive».

In Europe 5.700 million euro were traded within the hotel segment until June, but this number decreased 55% y-o-y. Amongst the main acquisitions in Europe were the Ritz London, with 136 rooms by a Qatari investor, as well as the purchase of hotel Nhow with 304 rooms in Berlin by Eastern Property Holdings. European investors represented 78% of transactions during the first semester of 2020.