During the opening remarks Richard Betts, Group Publisher at Real Asset Media, shared how after the 2008 financial crisis people though Iberia would not be on investors radar, which now proves to be far away from reality…people do want to invest in Spain & Portugal!

For its part, António Gil Machado, Director at Iberian Property, introduced some of the main key figures for the Spanish and Portuguese economies. The GDP growth stands out in both countries (Spain registering a 2% yearly growth, and Portugal 2,5%), mainly driven by exports; the government balance is still beyond desired, but debt is expected to be reduced; and so far 2023 is beating 2019 tourism levels, which is also being one of the growth motors for both economies.

Valdecarros Madrid – one of the largest urban development projects in Spain

Luis Roca de Togores, President of the Valdecarros Community Council, explained the audience how Valdecarros has accelerated in a particularly turbulent economic and political context, both internationally and domestically. Nonetheless, the Spanish economy grew by 0.5% in the first quarter of the year, compared with the 0.1% of the Eurozone. Spain has become well placed to lead economic growth over the next two years among the large-developed countries. The latest forecasts published by the European Commission and the IMF already placed the Spanish economy in the lead, as also confirmed by the OECD, raising the growth forecast to 2.1% in 2023 and 1.9% in 2024.

Spain has also ranked fourth among the most attractive European destinations for property investment, climbing three places from last year and only lagging behind the UK, Germany and France. Due to its legal security and tax advantages, Madrid in particular is one of the most sought-after cities in Europe for investing.

Three months ago, Madrid City Council approved the adaptation of the Valdecarros enabling works project to its execution, with a total budget of 1.8 billion euros, in eight stages. If we add the construction investments, this new Madrid neighbourhood will contribute more than 7.5 billion euros to Madrid and will create some 450,000 jobs.

Of these eight urban development phases, the first one is already underway since 2021 and the works for the second and third ones will begin shortly.

In the 16 years planned for the full development of the eight phases, a total of 51,000 new homes will be built, a third of the 150,000 planned for the entire capital over the same period. Of those 51,000, at least 55% will be under some form of price protection, so this new neighbourhood will henceforth be the epicentre of affordable housing in the city. In this regard, Valdecarros will provide the largest new housing stock in Madrid for the next two decades. It will be Madrid’s most inhabited and with the highest density of services and green areas neighbourhood.

“Public-private collaboration, proper urban planning and a comprehensive, stage-by-stage development such as ours make the best contribution to improving accessibility to housing, which is so badly needed by everyone and especially by young people”, stated Luis Roca de Togores.

Record of Iberian investment contribution to Europe

Following the macro & real estate economic outlook, Carlos García Redondo, Senior Director Investment Properties I&L at CBRE Spain, and Nuno Nunes, Head of Capital Markets at CBRE Portugal, have jointly presented the latest research insights for Iberia.

Portugal and Spain are growing more than most European countries. Although tourism keeps being a positive boost, there has been a very positive development in other sectors such as manufacturing and other industrial activities. On the other hand, public investment has also increase positively, which is something that hopefully will remain being fed into the economy in the next few years.

Regarding the general sentiment of the sector, the fast interest rate hike is a known issue and it explains a big part of why the market is so still, or why the investment volumes can decrease significantly this year. On Nuno Nunes words “a significant portion of the market is still trying to understand how to accommodate this shift into their current valuations, into their new investment programme”.

Carlos García Redondo agreed on the subject and reinforced that “almost 100% of Institutional investors need financing and this factor is critical for them, these forces of hike of the last 300 days it's taking time to time to adapt… and even for the for investors who don't take financing, they are still trying to understand what the correct pricing is, and no one wants to be catch falling”.

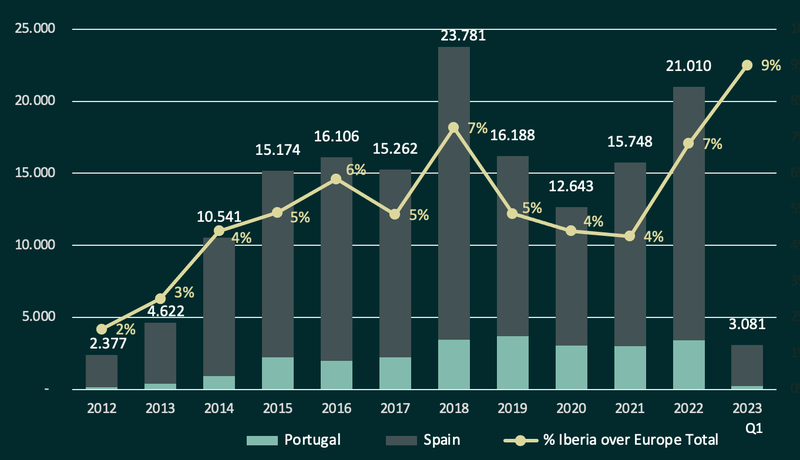

With one semester to go, it's more or less clear that we won't see the same investment volumes as we had last year or many years before that, and in fact for the European market as a whole the general sentiment is that we can be back to the levels of 2012/2013. However, Nuno Nunes points out the silver lining – Iberia investment volumes and the interest it has collected from international investors has increased significantly, and for the first time over the last 10 years Iberian investment is almost 10% of the total European volume, being the majority done by Spain.

Source: CBRE Research

STAY CONNECTED WITH IBERIAN PROPERTY TO ACCESS A FULL CONFERENCE REPORT, WITH ROUNDTABLE DISCUSSIONS AND POSSIBILITY TO ACCESS THE FOLLOWING PRESENTATIONS:

- The Iberian Economy & Master Planning Investment Opportunities

- Spain & Portugal – the macro & real estate economic outlook

- Legal & Tax update for Spain & Portugal. What should you know?

- Build to Rent, the new formula for residential investment!

- Where is “Alpha” for a diversified portfolio in Spain & Portugal?

(coming up next Monday in a "Special Story" format)