Colonial has confirmed its leadership in ESG and in particular the sustainable management of its asset portfolio by progressing on the path to carbon neutrality.

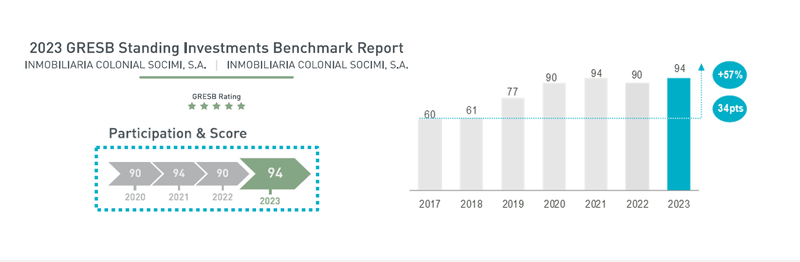

This is reflected in a score of 94/100 by the Global Real Estate Sustainability Benchmark (GRESB) for the real estate portfolio, improving the previous year's score by 4 points and rising to third place among the 100 listed European real estate companies included in the Standing Investments Benchmark.

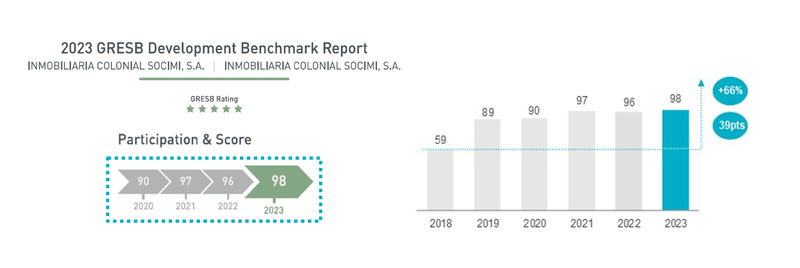

In the area of sustainable project management, 'Development Benchmark', Colonial has achieved a score of 98/100, improving on the previous year's rating by 2 points.

In both indicators, Colonial receives a '5 Star' rating for the fourth consecutive year, which shows its leadership alongside the best companies in the index, with scores equal to or higher than 90/100.

GRESB is the benchmark entity in the analysis of environmental, social and governance (ESG) practices. It analyses more than 2,000 companies worldwide and provides benchmark ESG ratings for analysts and investors, with a particular focus on improving the environmental footprint of buildings (energy, greenhouse gas emissions, water and waste) and on actions aimed at employees and/or asset occupiers.

Low Carbon Building Award', the latest recognition

As proof of the Colonial Group's firm commitment to the decarbonisation of the real estate sector, its French subsidiary has received the 'Low Carbon Building Award' at the SIBCA event held in Paris.

This award is recognition of the Group's firm commitment to reducing the environmental impact of its portfolio and its ambitious strategy to meet low carbon emission targets.

Obtaining BBCA certification for 100% of the redevelopment projects of its French subsidiary SFL in 2022 reflects the Colonial Group's ability to achieve this commitment. In the French capital, the Colonial Group's portfolio of assets is one of the first companies to obtain BREEAM certification for all the assets in its portfolio.

Colonial joins the 'Ibex ESG'.

As a result of the Group's good performance in sustainability and ESG in its full scope, Colonial is one of the securities included in the new 'Ibex ESG' index, an initiative of BME (Bolsas y Mercados Españoles) which aims to become a global benchmark in sustainability for the Spanish Stock Exchange and to promote investments under a sustainable approach. This new index selects its components according to certain sustainability criteria.

Colonial launched its decarbonisation plan in 2015, a pioneering move in the sector. Since that date, Colonial's portfolio of office buildings, which currently consists of 75 buildings in Barcelona, Madrid and Paris, has reduced its emissions by 75%. Emissions from Colonial's buildings are set to reach only 6Kg of CO2e/sqm by 2022, a decrease of (27%) year-on-year. The Group's decarbonisation trajectory is aligned with an average global temperature increase scenario of 1.5% and validated by the Science Based Targets Initiative.

This successful decarbonisation policy plays an important role in the fact that Colonial, with 95% of its building portfolio having environmental certifications, has one of the highest percentages in the entire sector in Europe. The low emissions of its buildings and their high environmental certification also contribute to its commercial success. Colonial's portfolio is 97% occupied, practically full occupancy, with a rental growth trajectory that exceeds the market average.

Pere Viñolas, CEO of Colonial, stated that "this distinction recognises the Group's strong ESG commitment, one of its fundamental pillars, and reaffirms its leadership in this area in Europe". Viñolas added that "Colonial was a pioneer in the integration of ESG policies into its business strategy, leading the decarbonisation process in its sector".